You need a loan to expand your business, consolidate debts, or cover unexpected costs. You opt for a secured loan because it offers lower interest rates and a higher borrowing limit. But then a question pops into your head, does a secured loan affect your credit score?

Your credit score is like your financial reputation. It influences your ability to borrow money, get a mortgage, or even secure favourable business deals. Understanding how secured loans impact your credit score can help you make smarter financial decisions and avoid common pitfalls.

In this article, we’ll break down the effects, both positive and negative, of secured loans on your credit profile, offering real-life perspectives and actionable strategies.

Understanding Secured Loans and Credit Scores

What Are Secured Loans and How Do They Differ from Unsecured Loans?

Imagine you need to borrow money for your business, but the lender asks for something valuable, your home, equipment, or another asset, as security. This is the essence of a secured loan. The lender has a safety net, which often means you can borrow more money at a lower interest rate.

On the other hand, unsecured loans don’t require collateral, but they come with stricter eligibility requirements and higher interest rates. Lenders take on more risk, so they compensate by charging more.

For a comprehensive comparison between secured and unsecured loans, refer to our article on the Differences Between Secured and Unsecured Business Loans.

What Is a Credit Score and Why Does It Matter?

Your credit score is like a financial report card. It tells lenders how trustworthy you are when it comes to repaying borrowed money. The higher your score, the better your chances of getting approved for loans, credit cards, and even favourable rental agreements.

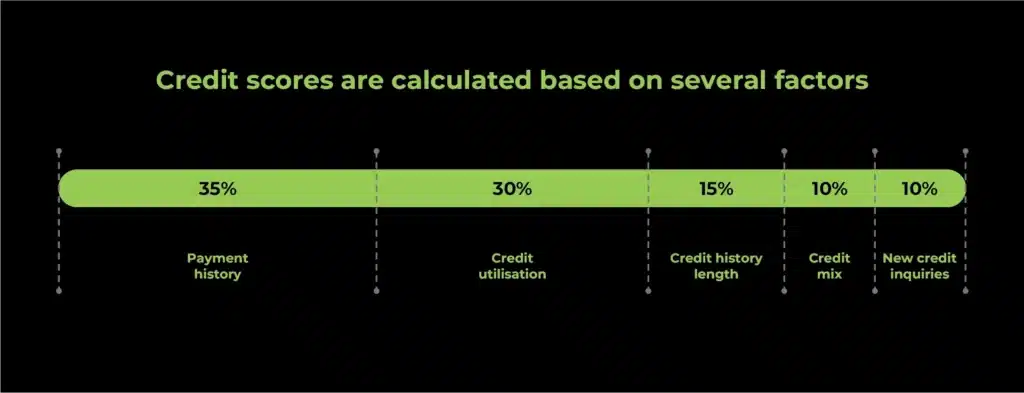

Credit scores are calculated based on several factors:

- Payment history (35%) – Do you pay your bills on time?

- Credit utilisation (30%) – How much of your available credit are you using?

- Credit history length (15%) – How long have you been using credit?

- Credit mix (10%) – Do you have a variety of credit types (e.g., loans, credit cards)?

- New credit inquiries (10%) – How often do you apply for new credit?

The Connection Between Secured Loans and Credit Scores

Secured loans can impact your credit score in both positive and negative ways. If managed correctly, they can boost your score by adding a history of timely payments. However, missed payments or defaulting on the loan can significantly harm your score and even put your assets at risk.

The Credit Impact of Secured Loans

How Secured Loans Can Improve Your Credit Score

- Boosts Your Credit Mix – Lenders like to see a mix of different credit types. If you’ve only had credit cards or personal loans before, adding a secured loan can demonstrate financial responsibility across various credit products.

- Improves Payment History – Timely repayments are the most significant factor in determining your credit score. Consistently paying a secured loan on time shows lenders that you are a reliable borrower.

- Reduces Your Credit Utilisation Ratio – If you use a secured loan to pay off high-interest credit card debt, your credit utilisation (the percentage of available credit you’re using) will drop, which can positively impact your score.

- Can Help People with Low Credit Scores – If you’ve had past financial struggles, secured loans offer a chance to rebuild your credit score, as long as you make repayments on time.

To explore how repaying a secured loan can help build your start-up’s credit score, see our discussion in Secured Business Loans for Start-ups: Is It a Good Option?

Risks of Secured Loans on Your Credit Score

- Missed or Late Payments – If you miss a payment, your credit score will take a hit, and it will remain on your report for up to six years.

- High Debt Load – Taking on a secured loan adds to your overall debt. If your debt-to-income ratio becomes too high, it may negatively affect your credit rating.

- Risk of Losing Your Asset – If you default, the lender has the right to repossess the collateral, which could mean losing your home, car, or business asset.

Learn essential tips to avoid defaulting on a secured loan for business and understand the potential risks involved in our guide on How to Avoid Defaulting on a Secured Business Loan.

Factors That Influence the Impact of Secured Loans on Your Credit Score

- Payment History: Consistently making your loan payments on time is the biggest factor in keeping your credit score healthy. Even one missed payment can cause a significant drop. Discover the role of credit scores in obtaining business loans and how payment history plays a crucial part in our article The Role of Credit Scores in Obtaining Business Loans in the UK.

- Loan Amount: Borrowing within your means ensures you don’t struggle with repayments. A large loan with high monthly payments can stretch your finances too thin.

- Length of Credit History: If this is your first loan, making regular payments can strengthen your credit profile over time.

- Existing Debt: If you already have multiple loans or credit cards, adding another loan may affect your ability to keep up with payments.

- Lender Reporting Practices: Not all lenders report to credit agencies. Choosing a lender that does ensure your responsible payments count toward building your score.

Common Misconceptions

“A secured loan won’t impact my credit score.”

False. Just like any other form of credit, secured loans are reported to credit agencies and will influence your score.

“Missing one payment won’t hurt much.”

Not true. Even one missed payment can cause a significant drop in your credit score and make it harder to borrow in the future.

“I should avoid loans if I have a low credit score.”

Not necessarily. If used correctly, secured loans can actually help rebuild a poor credit score.

Improving Credit with Secured Loans

Taking out a secured loan can be a game-changer for improving your credit score – but only if managed correctly. Whether you’re looking to rebuild your credit or take it to the next level, secured loans offer an opportunity to demonstrate financial responsibility. Here’s how you can use them to your advantage.

Strategies for Using Secured Loans to Enhance Credit Scores

- Make Timely Payments – Your payment history is the biggest factor affecting your credit score. Every on-time payment adds a positive mark to your credit history, reinforcing your reliability as a borrower. Late or missed payments, however, can have the opposite effect.

- Borrow Only What You Can Afford – It’s tempting to take out a large loan, but remember that borrowed money has to be repaid. Keeping your loan amount within a manageable range ensures you don’t overextend yourself financially.

- Keep Your Credit Utilisation Low – While secured loans aren’t factored into credit utilisation ratios like credit cards, lenders still look at how much debt you’re carrying overall. Responsible borrowing shows you’re not overly reliant on credit.

- Diversify Your Credit Mix – Credit agencies reward borrowers who successfully manage different types of credit. If you only have credit cards, adding a secured loan can help improve your credit mix, which makes up about 10% of your overall score.

- Maintain Long-Term Credit Accounts – The length of your credit history plays a role in your credit score. Keeping your secured loan active for a significant period, while making consistent payments, adds to the longevity of your credit history.

The Role of Timely Payments and Responsible Borrowing

Timely payments can’t be overstated. Lenders report to credit agencies, and your history of paying on time will directly influence your score. Think of it like a report card – every timely payment is a gold star. Miss just one, and it takes months to recover.

Beyond payments, responsible borrowing means understanding the terms of your loan, not borrowing more than necessary, and having a clear plan for repayment. Many borrowers damage their credit by taking on loans without a repayment strategy. Don’t let that be you.

Case Studies

At Funding Guru, we’ve seen secured loans transform financial situations. Here are two examples that highlight how secured loans can work for you:

- Case Study 1: John’s Business Revival

John, an entrepreneur, faced cash flow issues that prevented him from keeping up with supplier payments. His credit score took a hit due to late payments. With a secured loan, he cleared his debts and restructured his finances. Over 12 months of timely payments, his credit score improved by over 100 points, making it easier for him to access better financing options in the future. - Case Study 2: Anna’s Credit Rebuild

Anna struggled with past credit card debt and had difficulty getting approved for traditional loans. She took out a secured loan, ensuring she made every payment on time. Within a year, she had built a stronger credit profile, allowing her to qualify for a mortgage with lower interest rates.

Conclusion

A secured loan can be a strategic tool to build or improve your business credit score, but it’s not a shortcut. It requires discipline, planning, and responsible management. While it can help raise your credit score, missed payments or defaulting can set you back even further.

If you’re considering a secured loan, ask yourself: Am I ready to commit to the repayments? Do I have a clear plan for managing my loan responsibly? If the answer is yes, a secured loan could be a valuable step toward achieving your financial goals.

Ready to Take the Next Step?

If you want to explore secured loan options tailored to your financial needs, Funding Guru is here to help. Speak with our finance experts today and start building a stronger financial future.