A strong business credit score can open the door to better financing options, more favourable supplier terms, and increased trust from customers and partners.

For UK businesses, maintaining and improving this score is essential for long-term growth and financial stability.

Whether you’re new to funding and wondering how to improve your business credit score in the UK, this guide offers 9 proven steps to help you build and protect your financial credibility.

What is a good business credit score?

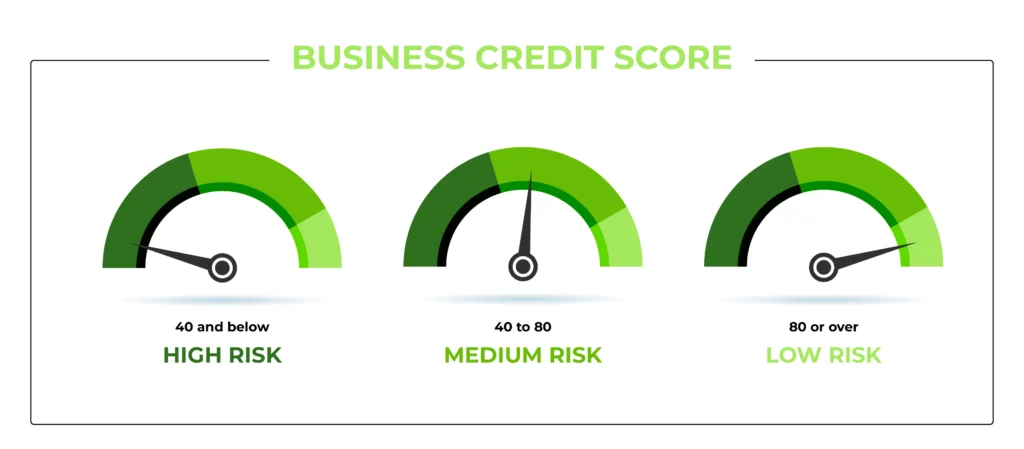

Before diving into how to improve your business credit score, it helps to understand what constitutes a “good” business credit score in the UK. Different credit reference agencies use various scoring systems, so definitions can vary slightly:

- Experian: Scores range from 0 to 100. A score of 80+ is generally considered low risk.

- Equifax: Uses a scale of 0 to 100, where 76+ indicates very low risk.

- Creditsafe: Also ranges from 0 to 100. A score of 71–100 is considered low risk.

Generally, a score above 70 with any major agency is regarded as strong and suggests a healthy credit profile. This score helps you access better credit terms, insurance rates, and funding opportunities.

However, if your score is lower than ideal, it doesn’t mean funding is off the table. Businesses with poor or limited credit histories can still access finance, it simply requires more strategic planning and the right funding partners.

Read our full guide on getting a business loan with bad credit to explore realistic options and expert tips for overcoming credit challenges.

Ways to Improve Your Business Credit Score

If you’re wondering how to improve business credit scores, read our top 9 strategies:

1. Check Your Business Credit Report Regularly

The first step to improving your business credit score is understanding where you currently stand. In the UK, several credit reference agencies, including Experian, Equifax, and Creditsafe, provide business credit reports.

Regularly reviewing your report helps you spot errors or outdated information that could negatively affect your score. For example, incorrect payment history or wrongly listed debts can drag down your score. By checking your report at least quarterly, you can dispute inaccuracies and ensure your data is up to date.

Here are the steps to follow:

- Identify relevant credit reference agencies: Sign up with UK agencies such as Experian Business Express, Equifax Business, or Creditsafe. Some services may offer free basic access or trial periods.

- Request and download your report: Look for outstanding balances, payment history, credit utilisation, and any County Court Judgments (CCJs) or defaults.

- Review all listed company information: Ensure company registration details, directors, SIC codes, and addresses are accurate and match what is on file with Companies House.

- Look for discrepancies or errors: Pay close attention to:

- Late or missed payments that you know were made on time

- Accounts or debts that don’t belong to your business

- Inaccurate outstanding balances

- Duplicate records

- Dispute inaccuracies promptly: Use the agency’s online dispute resolution process or contact them directly by phone or email. Provide supporting documentation where possible.

- Set a review schedule: Mark your calendar to review your business credit report every three to six months. This helps you stay on top of changes and address issues quickly.

Proactive monitoring ensures you aren’t caught off-guard by negative information and gives you the opportunity to resolve problems before they impact funding or supplier relationships.

2. Pay Suppliers and Creditors on Time

The ability to pay on time is an excellent indicator of creditworthiness. Most business credit scores consider payment history to be an important factor. The reliability of making vendor, lender, and service-provider payments by time of service exhibits reliability.

Tips to stay on track:

- Automate payments: Set up direct debits for recurring bills and reminders for manual ones.

- Use accounting software: Tools like Xero, QuickBooks, or Sage can help track due dates and cash flow.

- Communicate with suppliers: If a payment delay is unavoidable, notify the supplier in advance to maintain goodwill.

- Establish a buffer: Maintain a cash reserve to cover short-term obligations, preventing late payments during low-cash periods.

Even a single late payment can appear on your credit file, so consistency is key.

3. Reduce Existing Debt Levels

Managing your existing debt load is crucial to improving your credit score. High credit utilisation rates can signal financial stress and reduce your score.

How to reduce debt wisely:

- Make overpayments where possible: Pay more than the minimum to reduce interest costs and debt faster.

- Consolidate debts: Consider consolidating multiple loans or credit lines into a single, lower-interest facility.

- Negotiate better terms: Some lenders may agree to revise repayment terms if you’ve maintained a good relationship.

- Track and budget: Know exactly how much you owe and when repayments are due. Budget to prioritise reducing balances.

Lower debt can improve your business credit score and also make your business more resilient.

4. Establish Trade Credit with Suppliers

Building a history of responsible borrowing doesn’t always require bank loans. Trade credit offers a practical way to improve your business credit score.

How to build trade credit effectively:

- Choose reliable suppliers: Start with trusted vendors willing to offer net 30 or net 60 terms.

- Use trade credit wisely: Only take on what you can repay comfortably within the term.

- Request credit reporting: Not all suppliers report payments, so ask those who do to ensure your positive behaviour is recorded.

- Diversify trade accounts: Building credit with multiple suppliers creates a broader payment history.

Positive trade references can significantly enhance your credit profile.

5. Keep Your Business Details Updated

Inaccurate or outdated business information can hurt your score by creating inconsistencies across different databases.

What to keep updated:

- Companies House records: Regularly check your registration number, SIC code, and directors’ details.

- Bank records: Ensure your account name and address match your official records.

- HMRC and VAT details: Align tax registration and reporting data.

Tip: Create a checklist and review it quarterly to catch errors early and avoid mismatches that may delay credit decisions.

6. Use a Business Credit Card Wisely

A business credit card can be a strategic tool if used properly. It helps build your credit history and supports cash flow management.

Tips for responsible use:

- Set spending limits: Don’t exceed 30% of your available credit.

- Pay in full each month: Avoid interest charges and keep your utilisation low.

- Monitor spending: Review transactions regularly to prevent fraud or excessive charges.

- Use for regular business expenses: Recurring, budgeted expenses help build a predictable repayment history.

Responsible usage shows lenders that your business is disciplined and financially healthy.

7. File Full Annual Accounts

While filing abridged or micro-entity accounts can save time, filing full accounts can support your credit score.

Why full accounts help:

- Greater transparency: Lenders and agencies get a fuller picture of your financial health.

- Shows stability: Detailed records demonstrate maturity and reliability.

- Supports higher lending limits: With more financial data, lenders may approve larger loans.

Tip: Work with an accountant to ensure your accounts are clear, compliant, and submitted on time. For more information on the role credit scores have on obtaining business loans in the UK, view our helpful guide.

8. Avoid Frequent Credit Applications

Too many credit applications in a short time can be viewed as a sign of desperation or financial trouble.

How to minimise impact:

- Use eligibility checkers: These soft search tools help assess your chances without leaving a hard footprint.

- Plan ahead: Forecast your cash flow and financing needs to avoid rushed applications.

- Space out applications: Apply for new credit no more than once every 3–6 months if possible.

This approach protects your credit profile and reduces the risk of rejection.

9. Register for a Business Credit Score

Not all businesses automatically have a credit profile. Registering ensures your business is recognised by credit agencies.

Steps to register and build your profile:

- Register with credit reference agencies: Experian, Equifax, and Creditsafe offer business credit services.

- Submit financial information: Upload accounts, VAT filings, or trade references.

- Monitor your score: Use alerts and monitoring tools to track changes and improve over time.

Being proactive puts you in control of your credit standing.

Conclusion

Improve your business credit score as a strategic investment in your company’s future. From regularly checking your credit report to filing full accounts and managing your debt, each of the steps outlined above contributes to a stronger financial profile.

A better business credit score can mean the difference between securing a vital loan or being denied, gaining supplier trust or facing upfront costs. By following these nine practical tips, you’ll not only improve your business credit score but also lay a solid foundation for sustainable business growth.

Funding Guru is here to support UK business owners navigating the world of commercial finance. We offer resources, expert insights, and tailored guidance to help you improve your business credit score and position to secure the funding you need.

Learn how our team can help with funding options for growing businesses through:

Each solution is tailored to meet the unique needs of UK businesses at different stages of growth. Our experts can help you match the right finance option to your current goals and credit profile.

Improve your business credit score and start taking control of your financial future today with Funding Guru.