When you take out a business loan, it’s essential to know the ins and outs of how it works. This knowledge can protect against getting caught out later on.

At root, loans are simple. You borrow an amount of money and pay it back over an agreed amount of time with a bit of interest. The interest allows the lender to continue lending, and the money provides capital for your business when it’s needed.

But what happens if you can’t make the payments as stipulated by the terms of the loan?

Let’s take a quick look at definitions, first.

What is a Loan Default?

A default refers to the inability of a debtor to make their required loan repayments. If you’re unable to make several payments, continually miss payment deadlines, or decide to stop making payments altogether, you risk defaulting on your loan.

This term is enshrined in law, and a default judgement is the outcome of a legal trial.

What are Unsecured Business Loans?

An unsecured loan is one not secured against an asset. In the case of a default on a secured loan, the lender looks to recoup their losses by taking ownership of the asset(s) used as security. With an unsecured loan, however, this recourse does not exist.

Unsecured business loans offset the absence of security (and therefore increased risk) by offering shorter repayment terms, higher interest rates, and lower total loan amounts. Often, a guarantor will be required as well. They accept responsibility for repayment if the business borrowing the money is unable to fulfil its obligations.

What Happens if You Default on an Unsecured Loan?

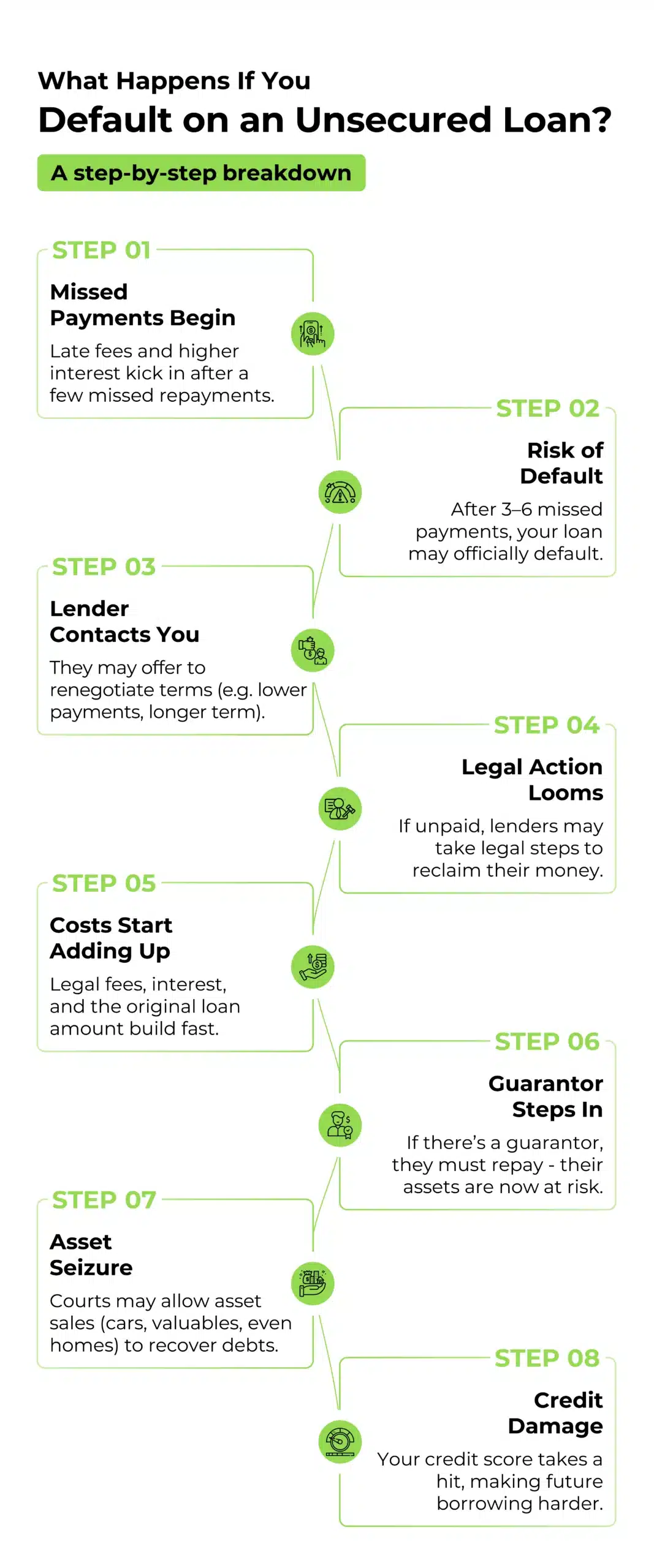

Missing a repayment doesn’t automatically mean default. Often, the first few late or missed payments will trigger fees, increased interest, and communication from the lender.

After several missed payments (usually three to six), you are at risk of defaulting on the loan. Doing so terminates the loan agreement, and the lender looks to other avenues to recoup their losses. Ultimately, it’s in the lender’s best interest that you’re able to repay, so the first port of call will usually be adjusting the terms of your loan. By offering lower payments over a longer period, the lender gives you a bit of financial leeway and increases the likelihood of future repayments.

If you’re still unable to pay, however, the lender will look to the courts to recoup their losses, as legal authorisation is needed before repayment can be sought. This process is long and convoluted, so lenders will often look to avoid it for as long as possible.

When seeking legal recourse, however, the lender will look to reclaim legal fees and expenses on top of the outstanding loan balance and interest payments. It’s easy to see how the costs of the default procedure can quickly skyrocket for a small business, so, it is best to avoid defaulting your loan payment.

Frequently, with unsecured business loans, a guarantor agreement is required. In the event of missed payments or default, the guarantor accepts the responsibility of repaying the loan. This will be the first avenue of recourse and can place the personal assets of the guarantor at risk. The guarantor’s liability remains even if the company owing money is dissolved.

Many of the guarantor’s assets are fair game at this stage. High-value possessions, cars, and even homes can be at risk. If the courts grant permission to the lender to recoup losses through the acquisition of assets, they will do so until the money raised at auction has met the total value of the loan, interest, and legal fees.

The next step is bankruptcy, but because this is worthy of an article in itself, we won’t go into details here.

Defaulting on any loan will badly affect your credit score, signalling to lenders that you have been unable to make repayments in the past. This will make it more challenging to secure funding in the future, so it’s of paramount importance that you avoid default.

How to Avoid Defaulting on an Unsecured Loan

If you’ve got an unsecured loan and you’re worried about defaulting, here’s what to do.

- Don’t panic. In most circumstances, there are steps you can take to prevent default if you approach things rationally.

- Speak to your lender. Remember: It’s in their interest that you’re able to repay, so they’ll likely be willing to make adjustments to the loan terms. This could be in the form of lower repayments over a more extended period or a temporary pause in repayments. The exact solution will depend on your current circumstances and repayment history.

- Speak to an accountant. Discuss with an accountant and find ways to efficiently manage your cash flow and ways to free up cash from other areas of your business, giving you the money you need to pay.

- Look into refinancing. If your lender isn’t willing to amend the terms of the loan, you may be able to take out another loan to meet your repayment obligations. While borrowing to repay a loan may sound counterintuitive, it may lead to more favourable repayment terms overall. Refinancing is possible through non-traditional routes like invoice financing, which unlocks capital from other areas of your business.

Prevention is the Best Medicine

Ultimately, it’s usually possible to avoid defaulting on an unsecured business loan by being diligent with your business finances. Sometimes unexpected things happen, and businesses can find themselves in dire straits surprisingly quickly, but there are steps you can take to avert disaster and unsecured business loan default consequences.

By being honest about your situation and speaking with your lender in good time, it’s often possible to reach an agreement that makes repayment possible. No lenders are looking to drive their customers into the ground, and at the end of the day, it’s in everyone’s best interest that you’re able to repay your loan.

If you have more questions about business finance, get in touch with one of our advisors today.