More than 50% of UK SMEs get rejected for a bank loan, often without knowing why.

If your loan has been declined, you’re not alone – and you still have options.

Banks, ironically, often struggle with the notion of ‘business lending’. Most banks won’t lend to a business unless it has a perfect credit record. This guide covers why banks reject business loans and what funding paths you can take next including alternative funding such as unsecured business loans.

The Five Biggest Reasons Why Banks Are Rejecting SME Loans

It’s no secret that the banks are not very easy to sway if you have anything on your credit file that indicates a less than perfect lending proposition and these are usually highlighted in these five most common reasons for a credit application to be rejected:

1. Your Business Credit Score

Having a low business score ensures that the banks have a pretty good reason to say no. It might be because of previous payment issues, high levels of debt, multiple credit applications or that your company performance just isn’t strong enough to warrant the risk of lending to you.

Understanding Business Credit Scores

Traditional banks in the UK remain highly conservative when it comes to lending, especially to small businesses. Many SMEs are rejected not because their business lacks potential, but because their credit profile doesn’t meet rigid scoring models set after the 2008 crash.

This becomes a serious obstacle when:

-

You’re a start-up or newly incorporated

-

You’ve had limited credit history

-

You’ve had past defaults or late payments

-

You’ve made multiple funding applications in a short span

📌 Tip: If your business doesn’t have much credit history, banks will often fall back on your personal credit profile — making that equally important.

2. New Business

Every new business has the same problem: being able to establish that they are not a high risk to the lender. Having little or no credit history at all can mean that your personal credit will be looked over in more detail and as with most applications based on personal credit, they will either require high levels of asset security or will reject you outright.

Quick Fix Tip: if you’re newly trading, focus on strengthening your personal credit, and prepare a detailed business plan with solid cash flow forecasts. Look into startup loans or revenue-based financing designed for new businesses.

3. Poor Personal Credit

Your personal credit rating is very important if you are applying for credit for your business. Even if your business is new, or you are applying for a small business loan you may well find yourself being asked for a personal guarantee to back it up. Either way, your personal financial situation is an important criteria for accessing small business credit.

Quick Fix Tip: before applying, check your personal credit score and clear small defaults or late payments. Where possible, avoid joint accounts with poor credit holders, and consider lenders that focus on business performance, not personal history.

4. Bad Credit History

It certainly isn’t unusual for small businesses to have experienced times of bad credit and inability to make payments. This is especially true when considering the shrinking of many supplier credit accounts when the economic recession hit and these supplier accounts have never really rebounded to the same levels since.

Quick Fix Tip: explain credit blips up front – especially if they relate to temporary cash flow issues. Demonstrate improvement via recent bank statements, or apply through a lender that specialises in adverse credit.

5. High Risk Industry

Some sectors are considered to be riskier than others and the banks are inherently risk-averse organisations. If they view your industry sector as not being stable, and this can change for any given bank, your finance application isn’t going to get through – regardless of how good your financial projections are or how sound your trading history.

Quick Fix Tip: back up your application with strong sector data and proven trading results. Alternatively, seek industry-specific lenders or flexible funding models like merchant cash advances that are better suited to seasonal or volatile revenue patterns.

The Problems Already Facing Business

There are a number of reasons why small businesses struggle to get their enterprises off the ground and then go on to grow them, and while the issue of finance might be their number one priority, it isn’t the only issue they face:

Operating costs

Energy prices have increased by 43% since 2010 which has proven very damaging for the UK’s small business sector. While energy costs remain high, business rates have also been on the increase and with it the continued stagnant drift on the UK’s high street has continued. It means that many business are now paying more in business rates than they are in Corporation Tax, which is also set to rise over the next five years, placing them at even more disadvantage from both online competition and retailers from abroad.

Wages

There is a very real danger that many small businesses are still struggling to cope with the implementation of the National Living Wage which was introduced in April 2016. It has almost certainly contributed to a large number of enterprises either scaling back expansion or closing up shop for good. A by-product of increased wages is reduced overtime, fewer bonuses, decreased productivity and increased costs to customers, which mitigate a business’s ability to expand and grow in their market.

Brexit

The continuing uncertainty of Brexit remains a looming shadow, especially for the UK’s import and export community but also for any business trading under the fluctuating economic conditions that this uncertainty brings with it.

Property

The value of the UK’s commercial property is rising at a rate that precludes many small businesses from buying and forcing them to rent. Purchasing is viewed as an unjustifiable option.

What these problems create for small businesses is a reluctance to both borrow further and expand their operations, fearing a big downward spike in their cash flow and damaging the day to day running of their businesses. Higher wages and operating costs (business rates and tax hikes) are high on the reasons for businesses failure to expand as rapidly as they want to and uncertainty in the economic conditions have impacted both raw material purchase and the ability to buy assets like property.

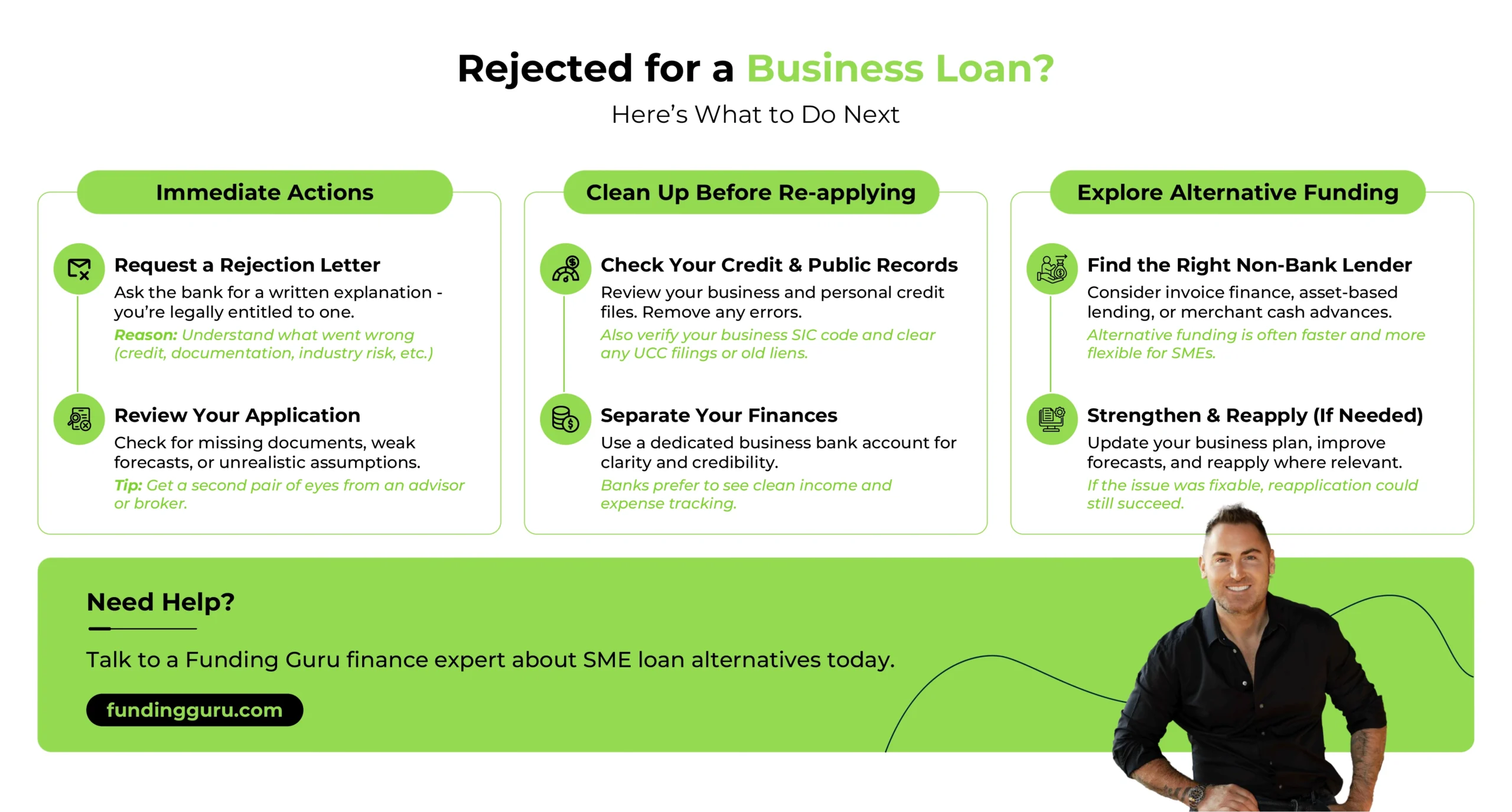

What to do Immediately After Rejection – Step-by-Step

A bank rejection can feel like a dead end, but it doesn’t have to be. What you do in the first 48 hours after receiving a “no” can make a big difference to your funding success. Here’s how to take back control — and pave the way to approval, elsewhere.

1. Request a Written Explanation (You’re Entitled to One)

Under UK lending rules, if your business is rejected for finance, the lender must explain why — either directly or through credit reference agencies. Don’t settle for a vague “computer says no.” Ask for a written response that outlines the exact reasons behind the decision.

💡 This gives you a starting point for fixing the right issues, rather than guessing.

2. Review Your Application & Credit File

Go back through your loan application as if you were the underwriter.

-

Were all the supporting documents accurate and up to date?

-

Did your business plan clearly explain how the funds would be used?

-

Were cash flow forecasts realistic?

Also, check your business and personal credit reports via providers like Experian, Equifax, or Creditsafe. Look for:

-

Incorrect data

-

Old CCJs

-

Missed payments

-

Red flags like multiple recent finance applications

🔧 If you find errors or outdated information, request corrections immediately.

3. Check Your SIC Code, UCC Filings, and Banking Setup

Often overlooked, these admin details can quietly sabotage applications:

-

SIC code: Ensure your company’s Standard Industrial Classification code is accurate on Companies House. Some codes flag you as high risk even if you’re not.

-

UCC filings (UK equivalent: charges): If another lender holds a floating charge over your assets, this may deter banks from lending further.

-

Bank account: If you’re running everything through a personal account, lenders may struggle to assess your true business performance.

💡 Fixing these small details can remove automatic rejections before they happen.

4. Speak to a Funding Specialist or Broker

Don’t go it alone. Business finance brokers understand the criteria of hundreds of lenders, including those open to newer businesses, imperfect credit, or unusual sectors.

A specialist can:

-

Recommend more suitable lenders

-

Help you repackage your application

-

Match you with alternative finance options like invoice funding or merchant advances

📣 At Funding Guru, we specialise in helping SMEs recover fast from bank rejection — with funding tailored to your business model and growth goals.

How Banks Actually Assess Your Credit Profile

Credit scores are used to judge how risky it is to lend to your business. The lower your score, the more likely your loan will be denied.

Banks check data from one or more of the UK’s main credit reference agencies:

-

Experian

-

Equifax

-

TransUnion (formerly CallCredit)

They look at:

-

Account history – how you manage bank and credit accounts

-

Public records – CCJs, bankruptcies, or defaults

-

Electoral roll – confirms your identity

-

Mortgage records – from the Council of Mortgage Lenders

-

Financial associations – anyone tied to your accounts

-

Credit searches – who’s looked at your file recently

📌 Your credit file keeps most of this information for 6 years. If your score seems unfair, you can dispute it directly with the credit agency.

Flexible Alternatives to Bank Loans in the UK

A bank rejection doesn’t mean your business isn’t fundable — it often just means you don’t meet outdated criteria. Fortunately, there’s a growing range of alternative funding options better suited to UK SMEs.

Here are some of the most accessible:

Unsecured Business Loans

- A flexible loan option with no need for asset security.

- Best for: Established businesses looking for a quick cash injection without putting property or equipment at risk.

Invoice Finance

- Turn unpaid invoices into immediate cash.

- Best for: B2B businesses with regular billing cycles.

- Quick approval, minimal credit requirements.

Asset-Based Lending

- Secure funding using your equipment, stock, or vehicles.

- Best for: Product-based businesses with valuable physical assets.

Merchant Cash Advance

- Receive funding repaid via a share of future card sales.

- Best for: Retail and hospitality businesses with steady card income.

- Repayments flex with your revenue.

Stock Finance

- Unlock funds tied up in unsold inventory.

- Best for: Retail, wholesale, or manufacturers carrying high-value stock

Government Loans

- Low-interest schemes for early-stage businesses.

- Includes Start Up Loans UK and British Business Bank-backed programmes.

Peer-to-Peer & Crowdfunding

- Raise funds via platforms powered by private investors.

- Best for: Businesses with loyal customers or strong brand appeal.

Why these alternatives work better than bank loans:

-

More flexible underwriting (frontier on performance, not just credit history)

-

Faster funding when you need it

-

Better alignment with business models, cash flow cycles, and growth paths

Rejection Isn’t the End – It’s the Start of a Smarter Funding Journey

If a bank has said no, it doesn’t mean your business is unfit, just that you didn’t match their narrow rules. With the right strategy, your funding future is still wide open.

- Know your numbers

- Fix what’s fixable

- Consider smarter, faster lenders

- Use experts who understand your sector

Ready to move forward? Speak to a Funding Guru advisor today and explore the funding options that fit your business, not just your credit score.