Buying commercial premises is often a prudent investment and having your own property can be a major business asset.

However, while there can be advantages of doing so there can also be some significant disadvantages too.

Why Get a Commercial Mortgage?

A commercial mortgage is a loan specifically designed for purchasing or refinancing business premises. Unlike residential mortgages, commercial mortgages are tailored to the unique financial structures and needs of businesses. They are available to businesses of all sizes, from sole traders to large corporations, and offer flexible terms based on the financial health of the business.

So can a business get a mortgage? Yes, let’s explore further.

Common Uses of a Commercial Mortgage in the UK

A commercial mortgage is not limited to simply purchasing business premises. It can also be used for various other business-related purposes, including:

- Purchasing business premises – A commercial mortgage allows businesses to buy office spaces, retail units, industrial facilities, and more, giving them greater control over their operational base.

- Developing new commercial property – If your business needs to expand or move to a new location, a commercial mortgage can fund the development of new premises.

- Renovating or extending existing premises – Businesses often outgrow their existing space. A commercial mortgage can finance renovations or extensions to meet growing business needs.

- Buying land for future development – If you plan to build new premises or develop commercial property, a commercial mortgage can provide the necessary funding to acquire the land.

- Refinancing existing commercial mortgages – If you have an existing commercial mortgage, refinancing it can help reduce interest rates, improve cash flow, or release capital for other investments.

- Converting residential property into commercial use – Businesses looking to repurpose residential properties can use a commercial mortgage to fund the conversion process.

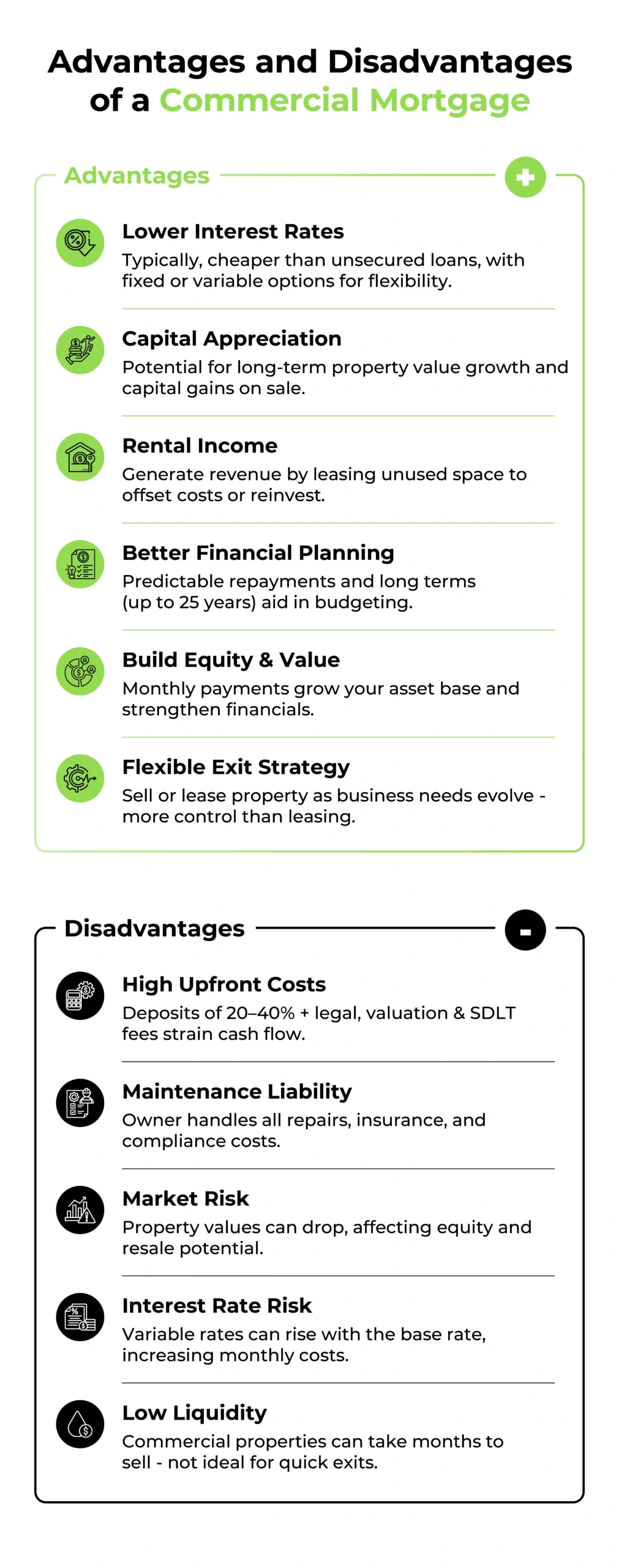

Advantages of Commercial Mortgages

Investing in commercial property through a mortgage offers numerous advantages that can strengthen your business’s financial position and operational stability. Here are some of the key benefits:

1. Lower Interest Rates

Commercial mortgages generally offer lower interest rates than unsecured business loans.

- Interest rates for commercial mortgages in the UK tend to be more favourable, especially when compared to alternative borrowing options such as business loans or overdrafts.

- Businesses can choose between fixed and variable interest rates, providing flexibility in managing monthly repayments and financial forecasting.

- Fixed-rate options allow businesses to plan their cash flow more effectively by locking in predictable repayment amounts.

2. Capital Appreciation

Commercial property in the UK has a strong track record of long-term value appreciation.

- Over time, the value of commercial property in key areas such as London, Manchester, and Birmingham tends to rise steadily.

- Owning commercial property gives businesses the opportunity to benefit from capital gains when property prices increase.

- If the property is sold at a higher price in the future, the business can realise a significant financial gain.

3. Rental Income Potential

If you have extra space within your property, you can generate additional income by leasing it out.

- Renting out unused office or warehouse space can provide a steady stream of passive income.

- This additional revenue can be used to offset mortgage repayments or reinvest in business growth.

- Leasing part of the premises can also improve the business’s overall profitability.

4. Financial Planning and Forecasting

Owning commercial property allows for better financial planning and budgeting.

- Fixed-rate mortgages provide predictable monthly payments, making it easier to manage cash flow and budget for future expenses.

- Commercial mortgage terms can extend up to 25 years, giving businesses ample time to repay the loan while maintaining operational flexibility.

- Knowing your exact mortgage repayments allows for more accurate long-term business planning.

5. Building Equity and Business Value

Unlike rent payments, which provide no long-term return, mortgage repayments build equity in the property.

- Each monthly mortgage payment increases the business’s ownership stake in the property.

- As the mortgage reduces and the property value increases, the business’s balance sheet strengthens.

- This can improve the business’s overall creditworthiness and financial stability.

6. Flexibility with Exit Strategies

A commercial mortgage gives business owners more flexibility if they need to relocate or close the business.

- If the business outgrows the premises, the property can be sold or leased to another business.

- Selling the property allows the business to recover its investment and potentially realise capital gains.

- Unlike a lease, where early termination penalties may apply, a mortgage offers more freedom to adapt to changing business circumstances.

Disadvantages of Commercial Mortgages

While commercial mortgages offer compelling benefits, they also come with certain risks and challenges. Here are some potential downsides to consider:

1. High Initial Costs and Deposit Requirements

The upfront cost of securing a commercial mortgage can be significant.

- Lenders typically require a deposit of 20% to 40% of the property’s value.

- Raising such a substantial deposit can put pressure on the business’s cash flow and tie up capital that could be used for business growth or expansion.

- Additional costs, such as legal fees, valuation fees, and Stamp Duty Land Tax (SDLT), further increase the financial burden.

2. Responsibility for Maintenance and Repairs

When you own a property, you are solely responsible for its upkeep.

- All maintenance, repairs, and improvements are the responsibility of the property owner.

- This includes costs for roof repairs, plumbing issues, heating system failures, and structural problems.

- Building insurance and health and safety compliance costs also fall to the business owner.

3. Property Value Fluctuations

Property prices in the UK are subject to market fluctuations.

- Economic downturns or market volatility can lead to short-term declines in property value.

- If property prices fall below the outstanding mortgage balance, it could affect the business’s net worth and borrowing capacity.

- Falling property values could make it harder to sell the property or secure additional financing.

4. Risk of Interest Rate Increases

Variable-rate mortgages are sensitive to changes in the Bank of England’s base rate.

- If the base rate increases, monthly mortgage repayments could rise significantly.

- Higher repayments could strain the business’s cash flow and profitability.

- Fixed-rate options offer protection from interest rate increases but may come with higher initial rates.

5. Potential Illiquidity

Selling commercial property can take time, especially in a slow market.

- Commercial properties are generally less liquid than residential properties.

- If the business needs to relocate or downsize quickly, selling the property at a favourable price could be difficult.

- The process of finding a buyer and completing the sale can take several months.

How to Secure a Commercial Mortgage in the UK

If you’ve weighed the pros and cons and decided to proceed with a commercial mortgage, here’s a quick outline of the steps involved:

- Assess Your Financial Position

- Find a Suitable Property

- Prepare a Business Plan

- Get a Professional Valuation

- Secure a Mortgage Offer

- Complete the Purchase

Your decision on whether to get a commercial premises mortgage will be influenced by much more than the pros/cons listed above. You can find out more about the steps to getting a commercial premises mortgage here.

Final Thoughts

Buying commercial premises in the UK is a major decision that can significantly impact your business’s financial health and long-term growth. A commercial mortgage provides numerous benefits, including capital appreciation, rental income potential, and enhanced financial stability.

However, the initial costs, maintenance responsibilities, and market risks must be carefully considered.

If you are interested in finding out more about buying your own business premises, property or land and how a commercial mortgage can help you then get in touch with us.