Securing financing is essential for many businesses looking to grow, manage their cash flow, or invest in new opportunities. You might wonder “can a house be used as collateral?” and yes, one common way to get better loan terms is by using real estate as collateral. While this approach has its advantages, it also comes with certain risks and challenges.

In this blog, we’ll dive into the pros and cons of using real estate as collateral for secured loans to help you make the right decision.

What is a Collateral Loan?

A collateral loan is a secured loan where the borrower pledges an asset, such as property or equipment, to reduce the lender’s risk. If the borrower defaults, the lender can seize the collateral to recover the outstanding debt.

What types of assets can be used as collateral?

Assets commonly used as collateral include real estate, vehicles, machinery, inventory, savings accounts, and even stocks. Lenders prefer assets that retain their value and can be easily sold if necessary.

Collateral Loans on Property for Secured Business Loans

Secured business loans are loans that require the borrower to provide an asset as collateral. This collateral acts as security for the lender, reducing their risk of lending money. Various types of collateral can be used for acquiring a secured business loan including real estate. When real estate is used as collateral, it often allows businesses to access larger loan amounts with better terms.

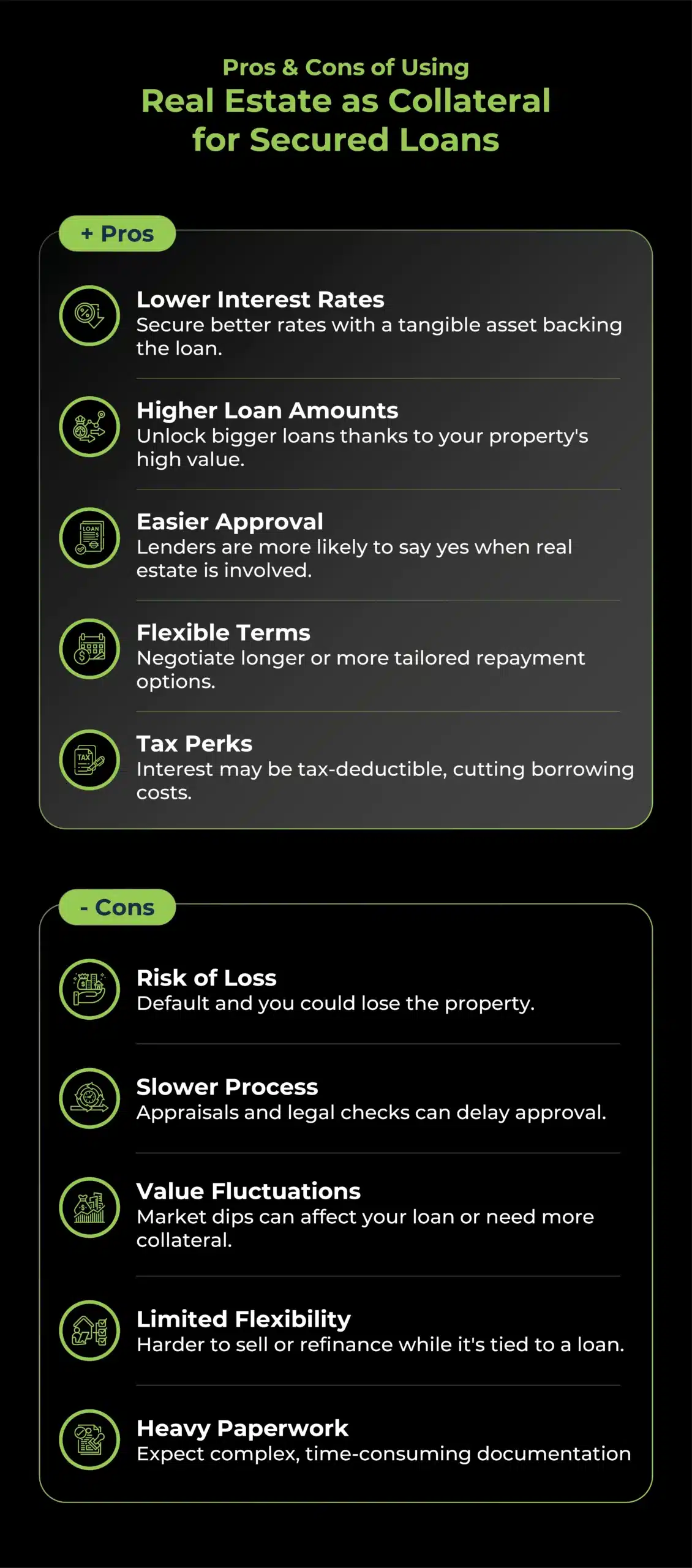

Pros of Using Real Estate as Collateral

1. Lower Interest Rates

Using real estate as collateral can often secure you lower interest rates. Lenders feel more confident offering better rates when they know they have a tangible asset backing the loan.

2. Higher Loan Amounts

Real estate is generally a high-value asset, which means you can often get larger loan amounts compared to other types of collateral. This is particularly beneficial if you need significant capital for expansion or large projects.

3. Improved Loan Approval Chances

Having real estate as collateral can improve your chances of getting approved for a loan. Lenders are more likely to approve loans secured by real estate because it reduces their risk.

4. Flexible Repayment Terms

With real estate backing your loan, you might have the chance to negotiate more favourable repayment terms. This can include longer repayment periods or tailored payment schedules that fit better with your business’s cash flow.

5. Tax Benefits

There are potential tax advantages to using real estate as collateral. For instance, the interest paid on a secured loan can often be tax-deductible, lowering the overall cost of borrowing.

Cons of Using Real Estate as Collateral

1. Risk of Losing the Property

The biggest risk of using real estate as collateral is the possibility of losing the property if you default on the loan. This can have serious consequences, affecting both your business operations and personal finances if the property is personally owned.

2. Longer Approval Process

Getting a loan with real estate as collateral usually involves a longer approval process. This is because of the need for detailed appraisals and legal checks to determine the property’s value and ensure there are no legal issues.

3. Fluctuating Property Values

Real estate values can fluctuate with the market. If the value of your property drops, it might impact your loan terms or require you to provide additional collateral.

4. Limited Use of Property

While your property is being used as collateral, there are restrictions on selling or refinancing it. This can limit your flexibility in managing your assets and capital.

5. Complex Documentation

Using real estate as collateral involves a lot of paperwork and legal documentation. This process can be time-consuming and might require professional assistance, adding to the overall cost of securing the loan.

When to Consider Using Collateral Loans on Property

Using real estate as collateral can be a smart move in certain situations. If your business has substantial equity in real estate and you need significant financing, this option might be beneficial. It’s also a good choice if you have a stable financial outlook and are confident in your ability to meet loan repayments. It is particularly worth considering in the following situations:

-

You have substantial equity in property

If you own commercial or residential property outright, or have a large amount of equity built up, you can leverage this asset to secure favourable loan terms. Lenders are often more willing to offer larger loan amounts and lower interest rates when valuable collateral is available. -

You need a large loan that unsecured finance cannot cover

Traditional unsecured loans might not offer enough funding for major purchases or investments. By using property as security, you may unlock higher borrowing limits that better meet your needs. -

You want to secure a lower interest rate

Collateral loans generally come with lower interest rates compared to unsecured loans, helping you to save money over the repayment period. Real estate is particularly attractive to lenders because of its typically appreciating value and stability. -

You have a stable financial outlook

If your cash flow is healthy and predictable, and you are confident you can meet monthly repayments, using real estate as collateral can be a safe and effective way to finance business expansion, new investments, or cash flow smoothing. -

You are consolidating higher-cost debts

Some businesses use secured loans to consolidate more expensive unsecured debts, replacing multiple high-interest payments with a single, lower-cost monthly repayment backed by property.

Alternatives to Using Property as Collateral

While real estate is a valuable form of collateral, it’s not the only option. Here are some alternatives:

- Inventory: Useful for retail or manufacturing businesses.

- Equipment: Ideal for companies with high-value machinery.

- Accounts Receivable: Suitable for businesses with strong customer invoicing.

Each alternative has its own pros and cons, and the best choice will depend on your business’s specific circumstances and needs.

Need Expert Advice on Using Property as Collateral?

Using real estate as collateral for secured loans offers several benefits, including lower interest rates, higher loan amounts, and better chances of loan approval. However, it also involves risks such as the potential loss of the property and a longer approval process. Carefully weigh these pros and cons, and consult with a financial advisor to determine if this strategy aligns with your business goals.

Contact Funding Guru today to explore your options and get expert advice on business financing solutions in the UK.