In today’s competitive property and business landscape, accessing capital often requires more than just traditional bank loans. That’s where mezzanine finance comes in, a flexible funding option that bridges the gap between senior debt and equity.

Popular in the UK for property development and business growth, mezzanine finance offers higher leverage without giving up full control.

In this guide, we’ll explain how mezzanine finance works, its benefits and risks, how it compares to other finance options, and how you can secure it through Funding Guru.

What Is Mezzanine Finance?

Mezzanine finance is a cross-over between debt and equity financing. It typically involves a loan that is unsecured (not backed by collateral) or other priority debts and can be converted into equity if the loan is not repaid on time. This conversion feature gives lenders a potential upside in the business while still earning interest.

The term “mezzanine” comes from its position in the capital structure, it’s the layer of capital that sits between senior debt (like bank loans) and equity (ownership shares).

How Mezzanine Finance Supports Property Development

If you’re considering getting a property development loan, you need to know the ins and outs of how mezzanine finance is used in property development before you make a decision.

- Funding is typically structured in a three-layer property development deal. The senior lender (typically a bank) would finance 60–70% of the entire development cost. The developer’s equity portion is normally 10–20%. That still leaves a gap of perhaps 10–20%, which is where mezzanine finance steps in.

- Mezzanine loans are structured to reflect the additional risk taken on by the lender. They come with higher interest rates, usually in the range of 12%–20%, and are subordinate to senior debt, meaning the bank gets paid back first if things go wrong. The return to the mezzanine lender is often flexible, it may be a combination of fixed interest, rolled-up or payment-in-kind (PIK) interest, and sometimes a share of project profits.

- This structure allows developers to maintain a higher degree of control over their projects and move faster, even if they don’t have all the capital from the outset.

Mezzanine Finance vs Other Funding Options

| Feature | Senior Debt | Mezzanine Financing | Equity Financing |

| Security | Secured | Subordinated/Unsecured | No repayment required |

| Repayment | Fixed interest | Interest + Equity Option | Depends on profits |

| Risk for Lender | Low | Moderate to High | High |

| Ownership Dilution | None | Possible | Definite |

Unlike traditional loans, mezzanine debt finance doesn’t always require physical assets as security, and unlike equity, it doesn’t always dilute ownership, unless converted.

Equity Features of Mezzanine Finance

A key characteristic of mezzanine financing is its blend of debt and equity features. Different from regular bank loans, mezzanine finance frequently comes with warrants, conversion rights, or equity kickers that may offer lenders a share in the success of the borrower.

Warrants

Lenders are allowed to buy shares in the company at a pre-agreed price per warrant (usually well below current market price). This way, if the company does well, the lender might also make money on the appreciation in share value, sharing in some of the upside in exchange for more risk.

Conversion Rights

Some mezzanine loans come with the right to convert debt to equity. It may be activated automatically under specific conditions or enacted voluntarily. It’s particularly common in high-growth or early-stage businesses where equity may become more valuable than regular interest payments.

Equity Kickers

These are bonuses that are contingent on company performance. You might, for instance, get a small piece of equity or profit share if the company’s financial goals are met. This aligns the lender’s interests with the company’s expansion.

These equity characteristics, along with higher risk involved in mezzanine finance (as mezzanine is junior to senior debt and is generally unsecured), help to compensate for the additional risk taken. They are also what make mezzanine financing an appealing arrangement for both sides, providing the borrower with flexible funding and the lender with the possibility of better returns.

Pros & Cons of Mezzanine Finance

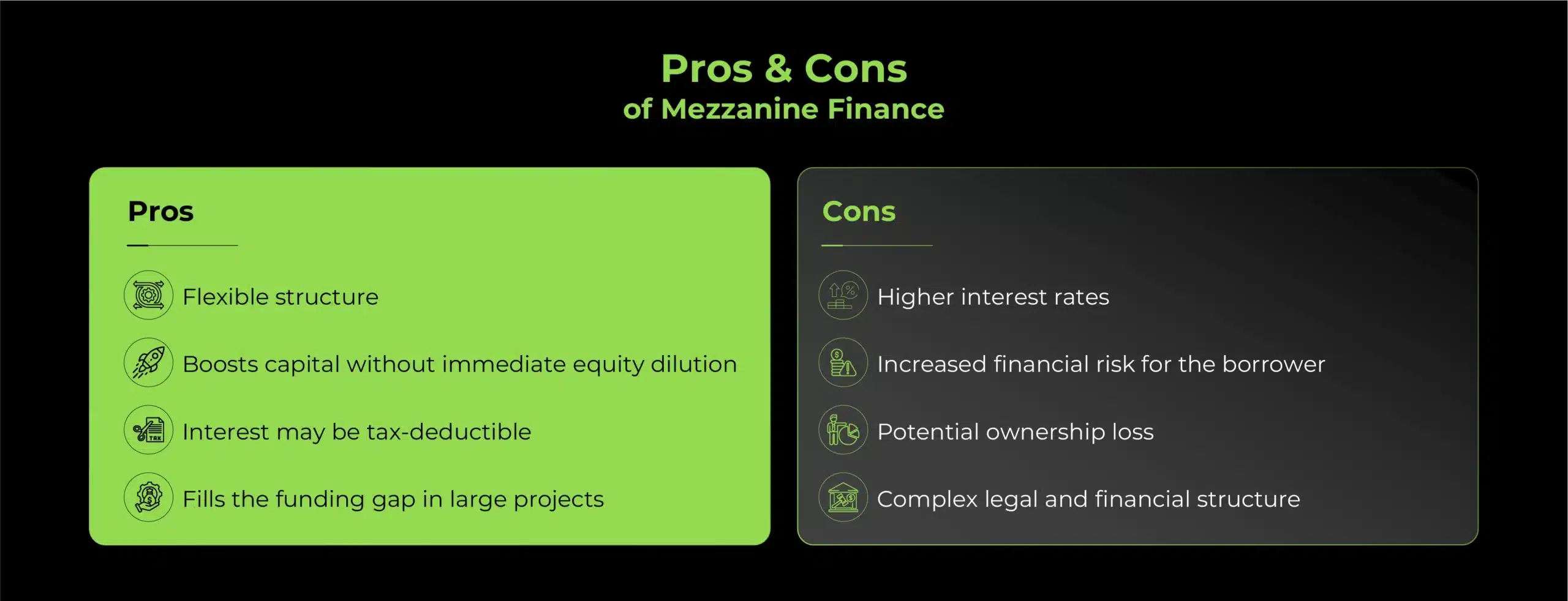

Advantages of Mezzanine Finance

- Funding Gap Bridge: Mezzanine finance fills the gap between senior debt and developer equity, enabling projects to proceed when traditional loans and equity don’t cover the full cost.

- Ownership Retention: Unlike equity investment, mezzanine finance allows developers to maintain control and ownership of their projects, avoiding dilution of their stake.

- Flexibility: Mezzanine loans offer flexible repayment options, such as fixed interest, rolled-up (PIK) interest, or equity-sharing arrangements, which can be adjusted to suit the project’s cash flow needs.

- Speed: Mezzanine finance is quicker to arrange than equity funding, saving valuable time for developers in competitive markets and ensuring that projects move forward without delays.

- Tax Deductibility: Interest payments on mezzanine finance may be tax-deductible, offering a potential financial benefit compared to raising capital through equity funding.

Disadvantages of Mezzanine Finance

- High Cost: Mezzanine finance carries high-interest rates, typically between 12% and 20%, which reflects the higher risk to the lender due to the subordinated position in the capital stack.

- Complex Structuring: The process of arranging mezzanine finance is more intricate than traditional loans, often involving second charges, personal guarantees, and equity kickers that require detailed legal work.

- Subordinated Risk: Mezzanine finance is subordinate to senior debt, meaning in case of default, senior lenders are repaid first, increasing the risk for mezzanine lenders and making it more expensive for developers.

- Borrowing Limitations: Taking on mezzanine finance may limit future borrowing capacity, as the added debt can affect how future lenders or banks assess the project’s financial stability and risk

Typical Lender Returns in Mezzanine Finance

If you’re thinking about using mezzanine finance to fund your next project, especially something like property development, it’s helpful to understand what kind of returns lenders expect, and why.

At Funding Guru, we offer mezzanine funding to help businesses and developers plug the gap between traditional loans and the cash they actually need. Since mezzanine sits between standard loans and equity, the returns for lenders are a bit higher, typically between 12% and 20% per year.

Here’s how those returns usually work:

Fixed Interest

Just like a normal loan, you’ll make interest payments on the money borrowed. Because mezzanine is a bit riskier for the lender, the interest rate is higher than a typical bank loan.

Payment-in-Kind (PIK)

Sometimes, instead of paying interest monthly, the interest is rolled up and paid at the end. This can help you keep cash in your business during key growth stages.

Equity Upside

In some cases, lenders like us may ask for a small stake in your project or profits. This gives us a reward if your project succeeds, and helps us offer more flexible terms upfront.

Mezzanine finance is ideal if you’ve already raised some funding but need that final boost to make your project happen. It’s a smart way to move forward without giving up control.

Mezzanine Finance in UK Real Estate Projects

In mezzanine financing real estate, the capital sits behind senior debt and ahead of equity. It’s commonly used in property development finance where traditional lenders won’t cover 100% of the costs.

Developers often combine:

- 60-70% senior loan

- 10-20% mezzanine finance

- 10-20% equity

This layered structure allows projects to proceed without diluting ownership too early.

What Is Mezzanine Capital and How Is It Used?

Mezzanine capital is the funds raised through mezzanine financing. It is often used in buyouts, expansions, or large-scale developments. The capital is riskier than senior debt but less so than pure equity.

Typical Features of Mezzanine Financing

- Subordinated Loan Position: Mezzanine financing is placed behind senior debt in the capital stack, meaning it is repaid only after senior debt is settled in the event of default.

- High Interest or PIK Interest: Mezzanine loans typically carry high interest rates, often between 12% and 20%, or payment-in-kind (PIK) interest, where interest accumulates and is paid at the end of the term.

- Equity Conversion Options: Some mezzanine financing agreements include options for converting debt into equity, allowing lenders to share in the project’s potential profits.

- Long-term Maturity: Mezzanine finance usually has a longer repayment term compared to traditional loans, offering more time for the project to generate returns before repayment is due.

- Minimal Covenants: Mezzanine financing often comes with fewer restrictive covenants, offering more flexibility to developers than senior debt or equity funding.

Example of a UK Mezzanine Finance Deal

Let’s say a property developer needs £10M to fund a project:

- A senior bank lends £6M

- The developer contributes £2M

- A mezzanine lender provides the remaining £2M at 15% interest with equity warrants

This structure gives the developer access to more funding while maintaining control.

Need Help Finding Mezzanine Finance in the UK?

If you’re looking to raise capital for property development or business expansion, Matt Haycox and the Funding Guru team can help you explore the best mezzanine finance solutions tailored to your project. With years of experience and access to UK-based mezzanine lenders, they provide end-to-end support.