Property development has long been seen as one of the most lucrative investment opportunities in the UK. From refurbishing single homes to building multi-unit developments, many investors are drawn to the potential of high returns.

But it’s also more complex and capital-intensive than ever. Rising costs, planning delays, and tighter margins mean profitability depends on preparation, execution, and having the right finance in place. One big question remains – is property development profitable in the UK?

Whether you’re eyeing your first refurbishment or a multi-unit build, this guide explores how developers make money, average UK profits, and the key factors that affect success in 2025 and beyond. If you’re considering your first project, understanding your development finance options is a vital first step.

How Do Property Developers Actually Make Money?

Property developers make money by adding value to land or buildings through construction, renovation, or conversion. The key is to buy low, develop efficiently, and sell high.

Profit is generated by increasing the Gross Development Value (GDV) – the total market value of the completed project – while keeping costs under control. Developers typically make money in the following ways:

- Buying undervalued property or land and enhancing its value through planning permission or development.

- Renovating or converting buildings to increase market appeal and resale value.

- Building new homes or units on land to sell at a profit.

- Adding income streams, such as creating rental properties that generate ongoing cash flow.

Timing, market knowledge, and cost management are crucial. Developers also rely on strong relationships with lenders, contractors, and agents to maximise returns. With the right strategy, property development can deliver both short-term profits and long-term wealth.

Access to the right finance solution can make or break a deal – especially when managing staged costs or time-sensitive purchases.

For a detailed breakdown of financing stages and strategies, refer to our step-by-step guide to property development finance.

Is Property Development Profitable in the UK in 2025?

Yes, property development can still be profitable, but the margin for error is smaller than it used to be. Developers need to be smarter, more efficient, and more aware of market trends.

In 2025, profitability depends heavily on:

- Location (e.g., London vs. regional towns)

- Project type (renovation vs. new build)

- Access to finance and favourable purchase prices

- Planning permission and timelines

With proper planning and cost control, developing property for profit is absolutely still possible, but it’s no longer a guaranteed path to riches.

How Much Profit Do Property Developers Make?

The average profit from property development in the UK varies greatly depending on the project. On small residential refurbishments, developers may make £20,000–£50,000 per project. Larger developers working on multi-unit schemes can generate six- or seven-figure profits.

That said, these profits only come after all costs – including land, construction, legal fees, interest, and taxes – have been accounted for.

For new builds or larger developments, profit margins are often targeted at 20–30% of the Gross Development Value (GDV), though actual profits may fall below that depending on delays, rising costs, or market changes.

Average Property Developer Profit in the UK

On average, property developers in the UK aim for the following profit margins:

- Small developments: 10–20% profit margin

- Mid-size refurbishments or conversions: 15–25%

- Larger new builds: 20–30% (target)

Keep in mind, these are targeted margins, real profits may be lower due to unplanned costs or market shifts.

Hitting a decent profit margin often depends on securing competitive finance terms and keeping interest costs low.

How do property developers get finance?

Property developers often rely on development finance to fund land purchases and construction. These short-term loans are released in stages, helping manage cash flow throughout the build. Consider bridging loans for quick access to funds during transitional phases of your development.

At Funding Guru, entrepreneur and investor Matt Haycox offers flexible, expert-led finance solutions tailored to each project. Whether you’re a first-time developer or scaling up, Matt and the Funding Guru team can help structure the right funding to maximise your profit and minimise risk.

Get in touch and fill out your funding application today.

Key Costs That Impact Profit

To understand how much property developers make in the UK, you need to look at the costs involved in each project. These can include:

- Land acquisition costs

- Planning and architectural fees

- Construction and materials

- Labour and contractors

- Legal, surveying, and professional services

- Finance and loan interest

- Stamp Duty and taxes

- Marketing and estate agency fees

Every one of these costs eats into the potential profit. Efficient cost management is critical for success.

What Makes a Great Property Developer?

Successful property developers stand out by combining vision with discipline. Key strengths include strong market knowledge, the ability to spot undervalued opportunities, and a solid grasp of planning and construction processes.

Great developers are skilled at managing budgets and timelines, working with reliable contractors, and adapting quickly when challenges arise.

Just as important is the ability to secure the right finance, ensuring the project stays on track from start to finish. Communication, negotiation, and long-term thinking are also vital, turning each development into not just a project, but a stepping stone to sustainable profit.

Property Development Profit Margins – What’s Considered Healthy?

A “healthy” property development profit margin in the UK is generally around 20% of the GDV (Gross Development Value). This means if a finished property will sell for £500,000, a developer would aim for at least £100,000 profit.

However, in today’s market, margins of 15–20% are more realistic due to rising construction and finance costs.

Investors must also build in a contingency of 5–10% of the build cost to account for unexpected expenses.

Securing funding isn’t just about rates – it’s about structure. At Funding Guru, we understand the realities developers face. That’s why our development finance is flexible, fast, and tailored to each project.

Economic Factors That Affect Profitability

Several economic factors can significantly impact the profitability of property development in the UK:

1. Interest Rates and Inflation

Higher borrowing costs reduce net profit, especially for projects funded with development finance. Inflation also drives up the cost of labour and materials.

2. Taxation and Government Policy

Changes in Stamp Duty, Capital Gains Tax, or VAT on building materials can hit margins. Planning delays due to local authority backlogs can also delay returns.

3. Labour and Material Shortages

In 2025, developers are still facing issues sourcing affordable labour and key materials, which affects project timelines and cost estimates.

4. Supply and Demand

If there’s a fall in property demand, due to higher mortgage rates, for example, developers may have to reduce asking prices or face longer selling periods.

How to Develop Property for Profit

If you’re looking to become a property developer or improve your returns, here are key tips:

- Buy below market value – Profits are made when you buy, not just when you sell.

- Know your end value (GDV) – Do detailed research to estimate future resale or rental values.

- Control build costs – Use fixed-price contracts and reliable contractors.

- Understand planning risks – Avoid delays by securing permissions early.

- Build in a contingency – Always have a 5–10% cushion in your budget.

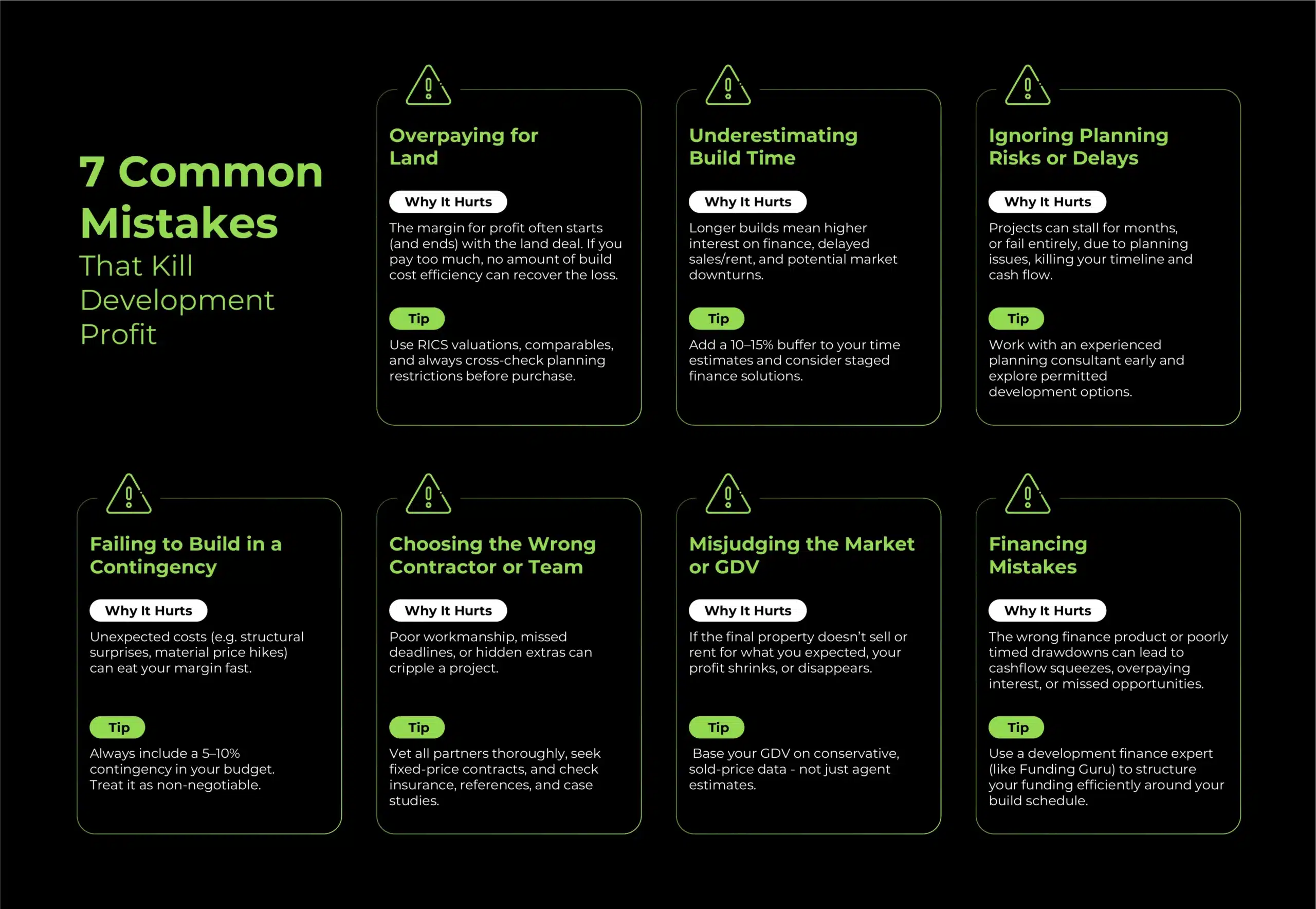

Common Mistakes That Kill Development Profit

Property development can be highly rewarding – but it’s also full of hidden risks that can eat into your margins before you even break ground. From overpaying for land to financing missteps, even experienced developers can make costly errors.

Before you start your next project, make sure you’re not falling into one of these seven common traps that silently kill profit.

Avoiding these mistakes doesn’t just protect your profit – it puts you in control of your entire development journey. Whether you’re planning your first project or scaling up, having the right finance partner is key to staying on track.

At Funding Guru, we help developers avoid costly errors by structuring finance that works with your project, not against it.

Ready to build with confidence? Explore development finance options here.

Is Property Development Profitable in the UK?

Yes – but only for informed, prepared, and financially stable investors.

Property development still offers solid returns in many UK regions, especially where housing demand remains high. However, it’s not a passive investment. It requires knowledge, capital, and risk management.

If you’re willing to commit the time and resources, property development is still worth it. For those looking for passive, lower-risk investments, other property options like REITs or buy-to-let may be more suitable.

Learn more about the application process in our guide on applying for property development finance.

Final Thoughts: Build Profitably with the Right Finance

Property development in the UK remains a profitable opportunity, but it’s no longer easy money. Developers must stay agile, control rising costs, and manage every phase with precision. Profitability depends on careful planning, realistic margins, and – above all – having the right finance in place from day one.

If you’re just starting out or scaling up to larger projects, expert funding support can be the difference between success and a costly setback. That’s where Funding Guru comes in.

Led by entrepreneur Matt Haycox, Funding Guru offers flexible, tailored development finance designed around your project’s needs – not a one-size-fits-all model. Whether you’re a first-time developer or a seasoned investor, Matt and his team provide more than funding – they offer hands-on insight to help you structure deals smartly, avoid common pitfalls, and maximise your returns.

Ready to take the next step? Explore your development finance options with Funding Guru today, and build your next project with confidence.