For many SMEs and business owners the prospect of setting up the workplace pension scheme has been fraught with additional costs, labour time and effort. But the risks of not doing so are much heavier. Here is a guide to how auto-enrolment dates will affect your new business and how you can use small business finance to balance the costs.

From October 2017, any new businesses starting up will need to add in automatic enrolment to their financial to-do lists. You will need to enrol new employees immediately and if you started up anytime since 2012, then you really need to make sure you are already compliant.

A big part of this is in your financial planning – including financial advice in setting up pension schemes – and, if needed, seeking financial help through small business finance.

What Is The Workplace Pension Scheme?

The Pensions Act 2008 meant that every employer in the UK has to put their staff into a pension scheme and make contributions to it. This was called automatic enrolment and it applied to any employer employing at least one member of staff.

This means that if they are on your payroll and they work directly for you, then as an employer you need to enrol them into a workplace pension. An easy way of checking whether this applies to you is to visit the Pension regulator website and check out Duties Checker.

However, the minimum amount of contributions that you are currently paying into your employee’s workplace pension is changing. In two phases during 2018 and 2019 they are increasing and as the employer, you must make your minimum contributions:

Until 5 April 2018

Staff Contribution = 1% and Employer Contribution = 1%

From 6 April 2018

Staff Contribution = 2% and Employer Contribution = 3%

From 6 April 2019

Staff Contribution = 3% and Employer Contribution = 5%

Is Your Business Nearing Its Staging Date? You Need To Act Now

If you haven’t yet had to set up your Workplace Pension Scheme then time is certainly running out and you are getting ever-closer to your staging date.

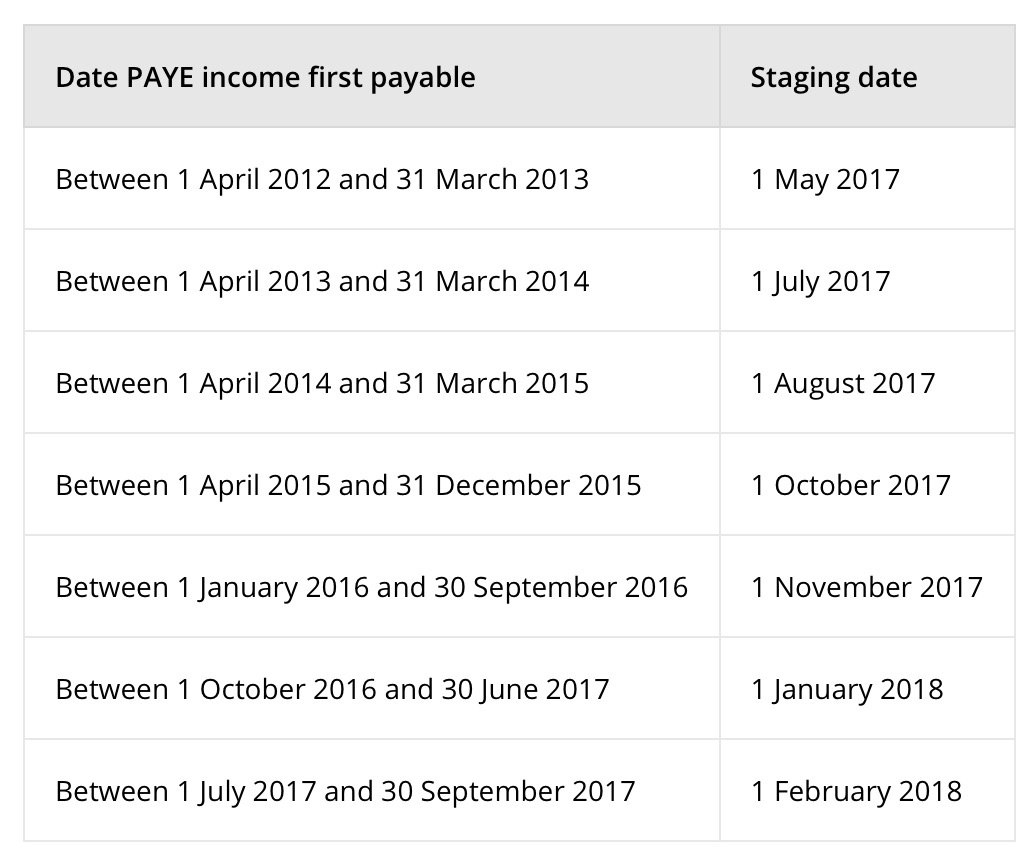

For new employers paying PAYE income for the first time from 1 April 2012 to 30 September 2017 your staging date is going to be between 1 May 2017 and 1 February 2018.

The table below explains what your staging date is if your business began employing staff after 1 April 2012:

Table taken from: The Pension Regulator

Why The Workplace Pensions Scheme Is Another Financial Pressure on SMEs

A recent survey of SMEs asking what the biggest challenges are likely to be found included in a long list of concerns included employment law, regulations, skill shortages, digitisation, taxation and business development – but found that the affordability and financial pressures of setting up the workplace pension scheme was high on the list.

The introduction of the Workplace Pensions Scheme will have a big impact on SMEs and the it begs the obvious question of “How am I going to afford to pay for it?”

Jill Barnes, chief executive of Exemplas says:

“One of the biggest challenges identified was the impact that the legal requirement for an auto-enrolment pension scheme will have on their already stretched time and finances. In particular, smaller companies we surveyed commented that they simply do not know where the money will come from to fund this scheme.”

Another report found that the onset of the Workplace Pension will affect SMEs in the following way:

- Affect pay rises and bonuses for more that 1 in 3 business

- Concerned that the additional cost might be enough to put them out of business equating to 21% of business employing 1-5 staff

- 72% of employees were left concerned that their pay rises will be at risk

- 26% responded by stating that it would mean not being able to afford to take on new staff

- Over a third of businesses were left believing that the only way to afford the costs was to increase their prices to customers.

Pay rises, business growth and increased selling costs were highlighted as the clear financial pressures coming from the introduction of the Workplace Pension Scheme and the phased increases to the contributions required.

The Financial Penalties For Not Complying

You will have no doubt seen the many advertisement warnings of non-compliance of auto-enrolment on TV or have heard the ‘Don’t ignore the workplace pension scheme’ campaigns on the radio.

Now running a small business isn’t easy, and auto enrolment is yet another financial pressure stacked onto it. But if one thing is clear, it’s that ignoring it will mean additional fines and penalties being charged against your business.

Figures from the Pension Regulator show that the number of fixed penalties and fines s increasing, meaning not only are some companies ignoring their legal duty, but are actually paying a heavy price for not doing so.

Before being fined, companies receive informal guidance and warnings, statutory notices and then fixed penalty notices of £400. After this a business might be charged fines of between £50-10,000 per day depending on the workforce size.

There are perhaps two reasons why businesses and business owners are failing to comply, the first, quite simply is that they are leaving it too late to set up, perhaps they don’t understand the complexities of setting up a workplace pension scheme or have not been diligent in knowing the timescales involved in doing so.

The second reason is perhaps more pertinent to thousands of businesses across the UK, that they cannot afford to do so.

How SMEs Can Use Business Finance To Comply With Auto Enrolment

The costs of setting up auto enrolment have also been underestimated, with average costs, just to set up the scheme ranging from £1,400 to over £2,000. Which has reportedly meant that some businesses have either cut or frozen wages to compensate this.

One solution to the problem of affordability is to ensure that there is cash flow available to make it happen, there are three considerations:

- Opt out – It is expected that between 25-50% of employees will opt out of auto enrolment, although it is good practice to assume that 100% will not.

- Financial provision – Are your HR and finance departments ready to handle the extra burden of employee pensions and should you consult a financial advisor?

- Salary sacrifice – Are your employees willing to sacrifice part of their salary to make it affordable? Lost income can be be put into their pension plan and this can lower the amount employers spend on National Insurance thereby reducing the cost to the business.

But there are two problems to this, firstly, it is illegal to encourage employees to opt-out, and secondly, cutting salaries and benefits will either disenfranchise your employees or mean they will seek alternative employment, where the benefits package is better.

Business Finance Options

Surviving the new auto-enrolment pension regulations means establishing that you have enough cash flow to afford it. This might mean making certain cost-cutting measures or applying for small business finance to overcome your short-term capital deficit.

Small business finance options like small business loans can help SMEs budget for the implementation of the auto-enrolment, as well as help manage the financial implications of running it. Whether this is a short-term business finance tool or one that can be incorporated into existing cash flow will depend on the new pension regulations that will expose your available cash reserves.

Employing additional payroll staff – Many small business owners are already time-short, without having the added burden of dealing with employee pensions alongside the other business accounting responsibilities. So perhaps you should look to employ additional payroll staff, perhaps on a short-term or temporary basis to ensure that this potentially complex process is done smoothly, without being unduly exposed to any frightening cost.

Purchasing payroll software – When auto enrolment is fully integrated into your payroll software. It means you don’t have to export or import third party data, it is a one-and-done method of ensuring all payment and workplace pension data is contained in one piece of software, giving you peace of mind that your employee-obligations are being completed.

Using small business loans – As previously mentioned, setting up a workplace pension scheme will cost a minimum of £1,400 and some will even be over £2,000. If this is a sum not isn’t readily accessible, or if your company suffers from poor cash flow or even bad credit, then taking a out a small unsecured business loan against this might ease the immediate burden of establishing auto-enrolment within your company.

Time is definitely running out for any business not already set up with a workplace pension scheme. Auto-enrolment has already rolled out and the financial consequences of not having one in place are heavy.

If you are looking to use small business finance to help generate capital for your business and are concerned with the costs of doing so, talk to Funding Guru, we offer small business finance options to a number of companies requiring an immediate cash boost. Call us on 03330 069 141.