The British financial landscape is as diverse as it is complex.

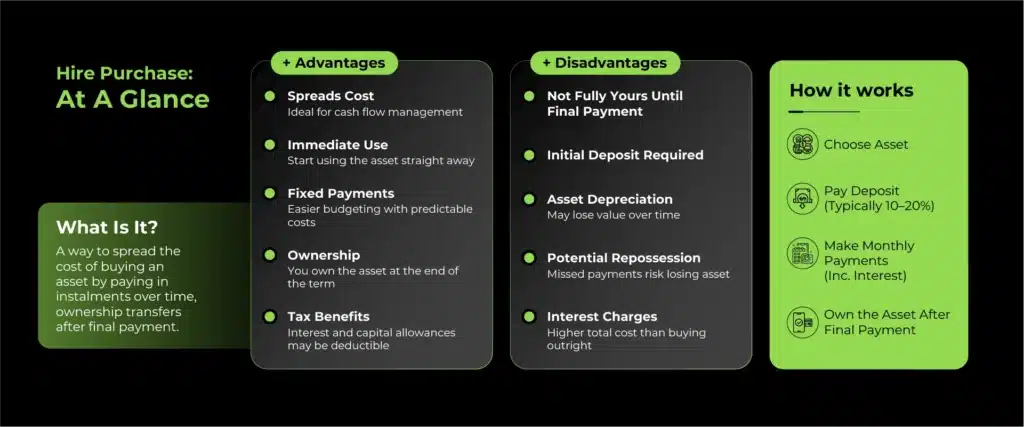

Among the numerous financing options available to businesses, hire purchase stands out as a popular choice. But like any financial instrument, understanding the advantages and disadvantages of hire purchase is crucial for making informed decisions.

Let’s dive into the intricacies of this financing method.

What is Hire Purchase?

Hire purchase (HP) is a form of asset finance where a buyer pays for a product in instalments. Once all payments are completed, the ownership of the product transfers from the seller to the buyer. Commonly used for acquiring cars, machinery, and other high-value items, it allows the buyer to use the product while they’re still paying for it.

Asset Accessibility

For many businesses, especially startups and SMEs, acquiring high-value assets like machinery, vehicles, or specialised equipment can be financially daunting. HP provides a pathway to access these assets without the need for a large upfront payment. This means businesses can utilise essential assets to generate revenue, even as they’re still in the process of purchasing them.

Cash Flow Management

In the unpredictable ebb and flow of business finance, maintaining positive cash flow is paramount. By opting for HP, businesses can better manage their cash flow, ensuring they aren’t depleting their reserves on a single high-value purchase. Instead, the cost is spread over a more manageable period, allowing for better financial planning and allocation of resources to other critical areas.

Asset Maintenance & Upgrades

Some HP agreements come with provisions for maintenance by the seller until the asset is fully paid off. Additionally, businesses can opt to upgrade to newer models or versions through new HP agreements, ensuring they always have access to the latest technology or equipment.

In conclusion, hire purchase isn’t just about acquiring assets; it’s a strategic move, allowing businesses to operate efficiently, stay competitive, and grow without being hindered by financial constraints.

Lets explore the advantages and disadvantages of hire purchase…

Advantages of Hire Purchase

Immediate Use Without Full Payment

One of the primary hire purchase advantages is the ability to use the product immediately without having to pay the full amount upfront. This can be particularly beneficial for businesses that need essential equipment to operate but may not have the necessary capital at hand.

Fixed Interest Rates

Unlike some other financing methods, HP agreements typically come with fixed interest rates. This means monthly payments remain consistent, making budgeting and financial planning easier.

Flexibility in Repayment

With HP, buyers often have the flexibility to choose the duration of their agreement, allowing them to adjust their monthly payments to suit their financial situation.

Ownership after final payment

Once the final payment is made, the buyer becomes the legal owner of the asset. This is different from leasing, where the asset is returned to the lender at the end of the term. (View pros & cons of Hire Purchase vs. Leasing Business Assets in our helpful guide.

Easier Approval Compared to Loans

Businesses with limited credit history may find it easier to secure a hire purchase agreement than a traditional bank loan. The asset itself often serves as collateral, reducing the lender’s risk.

Tax Benefits for Businesses

Businesses can claim capital allowances on hire purchase assets, potentially reducing taxable profits. Some VAT-registered businesses may also reclaim VAT on the purchase.

Disadvantages of Hire Purchase

Total Cost Can Be Higher

One of the main hire purchase disadvantages is that, over the length of the agreement, buyers might end up paying more than the actual value of the product due to interest charges.

Ownership Only After Final Payment

Until the final instalment is paid, the product remains the property of the seller. This means that if a buyer defaults on payments, the seller can reclaim the product.

Commitment to Fixed Payments

Even if a buyer’s financial situation changes, they’re committed to the fixed monthly payments. This can put a strain on personal or business finances if unexpected financial challenges arise. Unlike leasing, hire purchase agreements do not allow for easy upgrades or changes to the asset before the agreement ends. If the asset becomes obsolete, the buyer is still responsible for completing the payments.

Depreciation Risk

If the asset (e.g. a vehicle) depreciates quickly, the buyer might end up paying more than the asset’s actual worth over time.

Real-Life Example: A Business Using Hire Purchase

Background:

A UK-based logistics startup, needed to expand its fleet to meet increasing customer demand. The company required two additional delivery vans but lacked the capital to purchase them outright.

Solution:

The company entered into a hire purchase agreement with a financial institution to acquire the vans, agreeing to pay £800 per month for each vehicle over a five-year period.

Outcome:

- The company was able to start using the vans immediately, increasing its delivery capacity.

- Monthly payments were manageable and predictable, allowing the company to maintain stable cash flow.

- After five years, the logistics company became the legal owner of the vans.

Challenges:

- The total cost of the vans, including interest, was higher than the upfront purchase price.

- If the company had faced financial difficulties, there was a risk of repossession before full ownership was transferred.

Conclusion:

Despite the higher overall cost, hire purchase allowed the logistics company to expand operations without a significant upfront investment, making it a viable option for businesses needing immediate asset acquisition.

Is Hire Purchase Right for You?

Understanding the advantages and disadvantages of hire purchase is essential to determine if it’s the right choice for your needs. While it offers the benefit of immediate use and fixed payments, it also comes with potential pitfalls like higher total costs and the risk of losing the product if payments aren’t met.

In the vast world of finance, where every decision can impact your financial health, it’s vital to stay informed. If your UK business required asset finance solutions and opportunities for growth, Funding Guru is here to help. Delve into our extensive resources or get in touch via our contact page today. Remember, making informed choices today paves the way for a brighter financial future.

Hire Purchase FAQs

Who benefits most from hire purchase agreements?

Hire purchase agreements are ideal for small businesses and individuals who need essential equipment or transport but can’t afford a large upfront payment. It’s especially helpful for tradespeople, logistics businesses, or new companies trying to preserve working capital while still acquiring vital assets.

Is hire purchase suitable for new businesses?

Yes, hire purchase can be a smart financing option for startups that need vehicles, tools, or machinery. It spreads costs and avoids large capital outlays early on. However, new businesses should ensure they have predictable income to keep up with the monthly payments, as missed instalments can result in repossession or damage to credit ratings.

Are there tax benefits to using hire purchase?

For businesses, there are often tax advantages. You can usually claim capital allowances on the item as if you owned it, and interest payments may be tax-deductible. However, the specifics depend on your business structure and accounting method, get in touch to understand the full benefits and implications.

Can I pay off a hire purchase agreement early?

Most hire purchase contracts allow for early repayment, which can reduce the amount of interest you pay overall. However, some agreements include early settlement fees or require you to pay a lump sum to close the deal. Always check the terms of your agreement to understand your options and any potential penalties.