Imagine an unexpected bill lands on your desk. Maybe your car breaks down, or an urgent medical expense pops up. You don’t have time to wait weeks for loan approval, you need cash fast. This is where unsecured loans come in. Unlike secured loans, they don’t require collateral, making them a quick and accessible option for many borrowers.

But how can you ensure you get approved as quickly as possible? The key is preparation.

In this article, we’ll explore the fastest ways to get approved for an unsecured loan, including choosing the right lender, preparing documentation, and improving your credit profile. Whether you have stellar credit or are worried about approval with bad credit, we’ll help you navigate the process efficiently.

Understanding Unsecured Loans

Characteristics of Unsecured Loans

Unsecured loans are a type of personal loan that doesn’t require you to pledge assets, like your house or car, as security. For a deeper understanding, you can read more in our article on Unsecured Business Loans Explained. Instead, lenders rely on your creditworthiness, income, and financial history to decide whether to approve your application. Since there’s no collateral involved, approval decisions are often made quickly, sometimes within hours.

Unsecured loans often come with slightly higher interest rates than secured loans because they usually pose a higher risk to lenders. However, they offer a quick and convenient way to access funds without the worry of losing valuable assets.

Comparison with Secured Loans

Let’s break it down in simple terms:

- Secured Loans: Require collateral (house, car, or savings). Typically lower interest rates. Higher borrowing limits. Risk of losing the asset if repayments aren’t made.

- Unsecured Loans: No collateral required. Approval based on credit score and income. Generally higher interest rates. No risk of asset repossession.

A secured business loan UK is like borrowing money with a safety net, the lender has a way to get their money back if you can’t pay. An unsecured loan, on the other hand, is based on trust and financial responsibility. To explore this further, see our discussion on Secured vs Unsecured Business Loans.

Common Uses for Unsecured Loans

Unsecured loans can be a lifeline in various situations, including:

- Debt Consolidation: Rolling multiple debts into one manageable monthly payment.

- Medical Expenses: Handling sudden healthcare bills without insurance coverage.

- Home Improvements: Renovating your property without tapping into your home equity.

- Emergency Costs: Covering unexpected events like car breakdowns or urgent travel.

- Business Investments: Helping entrepreneurs fund their next big idea without putting assets at risk.

No matter the reason, unsecured loans can provide peace of mind by offering quick financial relief when you need it most.

Factors Influencing Ways to Get Approved for an Unsecured Loan Quickly

1. Credit Score Considerations

Your credit score plays a huge role in how quickly you get approved. Learn about the Key Eligibility Criteria for Unsecured Business Loans to better understand this process. The better your score, the easier it is to access fast loans with favourable terms.

Impact of Bad Credit on Approval Speed

If you have a low credit score, lenders might see you as a higher risk, which can slow down the approval process. Some lenders will still offer unsecured loans to individuals with bad credit, but these loans often come with:

- Higher interest rates

- Stricter repayment terms

- Lower borrowing limits

Options for Individuals with Poor Credit

If your credit isn’t perfect, don’t panic! Some lenders specialise in quick loans for bad credit borrowers. Discover 7 Fast Ways To Get A Business Loan Within 24 Hours that might suit your needs. You can also boost your approval chances by:

- Applying for a lower loan amount

- Adding a co-signer with good credit

- Showing proof of stable income

2. Documentation and Application Process

Speeding up the loan approval process is all about being prepared. Lenders will need key documents to verify your financial standing, so having them ready can save time.

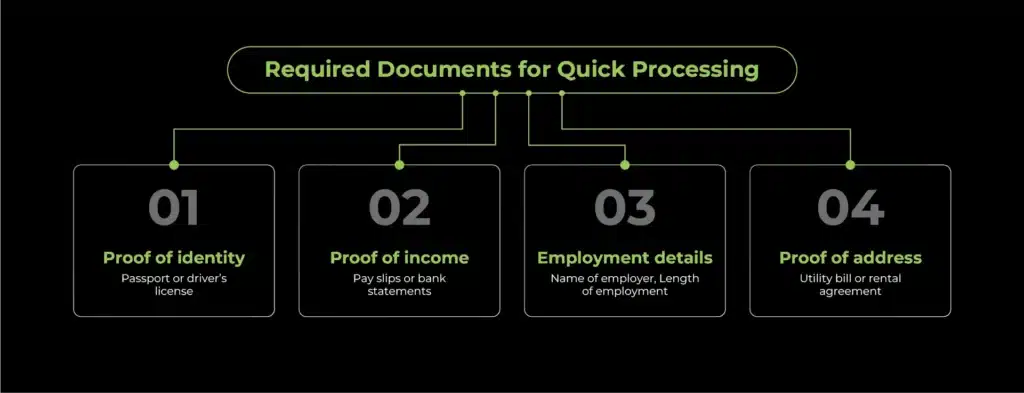

Required Documents for Quick Processing

Most lenders will ask for:

- Proof of identity (passport or driver’s license)

- Proof of income (pay slips or bank statements)

- Employment details (name of employer, length of employment)

- Proof of address (utility bill or rental agreement)

Tips for Completing the Application Efficiently

- Be honest – Incorrect information can delay approval

- Check lender requirements – Each lender has different criteria

- Apply online – Digital applications process faster than paper ones

- Use pre-qualification tools – These help gauge approval chances before a hard credit check

Strategies for Securing Easy Approval

Research Lenders with Fast Approval Processes

Not all lenders operate the same way. Some process applications in hours, while others take weeks. Our article on Unsecured Business Loans for Funding Rapid Expansion provides insights into lenders with swift approval processes. If you need quick approval, focus on lenders that specialise in fast, hassle-free applications. Many online lenders now use automated systems to assess eligibility within minutes, giving you near-instant decisions.

Before choosing a lender, check:

- Their approval speed (some promise funding within 24 hours!)

- Interest rates and repayment terms

- Customer reviews for reliability

- Hidden fees or early repayment penalties

Utilise Online Platforms for Quick Applications

The days of scheduling bank appointments and waiting weeks for loan approval are long gone. Now, you can apply for an unsecured loan from the comfort of your home. Online lenders and fintech platforms offer:

- Easy application forms: Submit your details in minutes.

- Faster processing: Automated credit checks mean quick decisions.

- Minimal paperwork: Some lenders don’t even require physical documents.

If speed is your priority, stick to reputable online lenders known for rapid approvals.

Pre-Qualification Options to Gauge Eligibility Without Affecting Credit Score

Worried about applying and getting rejected? That’s where pre-qualification helps. Many lenders offer a “soft check” option, allowing you to see your potential loan offer without impacting your credit score.

Benefits of pre-qualification:

- Helps you compare loan offers from different lenders.

- Gives you an idea of interest rates and borrowing limits.

- Saves you from unnecessary hard credit checks that could lower your score.

Before applying, always check if a lender offers pre-qualification, it’s a smart way to avoid surprises.

Conclusion

When life throws unexpected expenses your way, waiting weeks for loan approval isn’t an option. Unsecured loans provide a quick and accessible financial solution without requiring collateral. However, securing fast approval depends on choosing the right lender, preparing the necessary documents, and ensuring your financial profile is in good shape.

Everyone’s financial needs are different. Whether you’re consolidating debt, covering an emergency, or funding a personal project, it’s crucial to explore loan options that align with your situation. Take time to compare lenders, check eligibility requirements, and understand repayment terms before committing.

Need help finding the best loan option? Explore our tailored unsecured loan solutions at Funding Guru and take control of your finances today!