For small businesses seeking capital, choosing the right financing strategy can determine long-term success. Two primary routes to explore are crowdfunding and small business loans. Each offers unique benefits and risks depending on your business goals, financial situation, and timeline.

What Is Crowdfunding?

Crowdfunding is a modern way to raise capital by appealing directly to a group of people—often via online platforms—to fund a product or idea. Crowdfunding meaning varies, but the most popular models include:

- Reward-based crowdfunding (backers receive a product or service)

- Equity-based crowdfunding (investors receive shares in the business)

- Donation-based crowdfunding (donors contribute without expecting returns)

It works best when you have a product with mass appeal and strong marketing potential.

While the concept may seem new, its roots date back to the 1880s, when over 160,000 New Yorkers contributed to a campaign—led by The World newspaper—to raise $101,000 to complete the Statue of Liberty. Most gave less than a dollar, but collectively, they made history.

Modern crowdfunding for business has evolved dramatically. Platforms like Crowdcube, Seedrs, and Kickstarter offer diverse funding models. For entrepreneurs, it provides access to capital, market exposure, and validation. For investors, it offers unique opportunities to back early-stage ventures or real estate projects. However, it’s not without risks.

Understanding Small Business Loans

Small business loans involve borrowing a lump sum from a lender—usually a bank or alternative finance provider—that must be repaid over time with interest. Common types include:

- Secured loans (backed by assets)

- Unsecured loans (no collateral required)

- Government-backed schemes (e.g., Start Up Loans in the UK)

one lender of the viability (profitability) of your business in order to attain the full amount needed. Traditional small business loans have set terms for repayment and these are never negotiated after agreement, offering a fixed timeframe setting out equal monthly repayments.

A small business loan is a predictable and stable source of finance, which ultimately allows you to stay in control of your own business, without having to defer to shareholders or investors.

However, your qualification criteria (credit score/financial records) might prohibit you from obtaining a loan.

So, while crowdfunding relies on the meritocracy of your product and your business proposal, conversely the limitations of a business loan are rooted in the strict qualifying criteria of the underwriting.

A business loan provides a predictable and stable source of finance, ideal for those with good credit and solid financial history.

Crowdfunding Platforms: Options in the UK

UK businesses can explore various crowdfunding platforms such as:

- Kickstarter – Best for reward-based product launches

- Indiegogo – Flexible funding and global reach

- Crowdcube & Seedrs – Equity-based crowdfunding

- Funding Circle – Peer-to-peer business loans

- Pitchin – A rising UK platform focused on community-led investing

Pitchin crowdfunding offers curated campaigns, low fees, and dedicated investor communities—ideal for SMEs with growth potential.

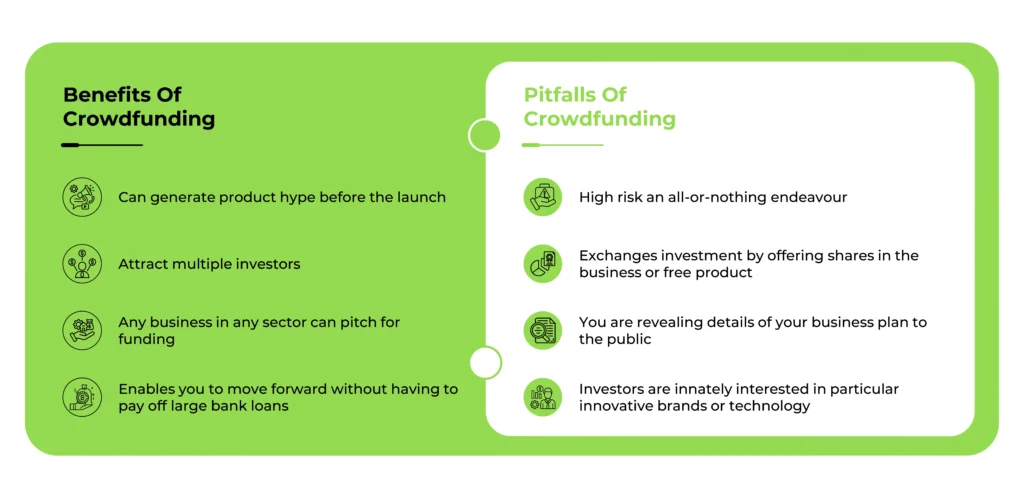

Advantages and Disadvantages of Crowdfunding

Benefits:

- Generate hype and visibility before product launch

- Raise capital without traditional debt

- Access to multiple investors

- Suitable for any sector or niche

Pitfalls:

- All-or-nothing risk model

- Must publicly share your business plan

- Fulfilment obligations to backers can be resource-heavy

- Crowdfunding platforms are competitive—many campaigns fail without aggressive marketing.

Advantages and Disadvantages of Small Business Loans

Benefits:

- Predictable repayments with set terms

- No need to give away equity

- Retain full business control

Pitfalls:

- Strict eligibility and credit checks

- Can involve collateral or personal guarantees

- Lengthy application and underwriting process

Key Differences between Crowdfunding and Small Business Loans

- Eligibility: Crowdfunding depends on public interest; loans rely on financial credibility

- Repayment: Loans require regular payments; crowdfunding may offer equity or product rewards

- Funding Speed: Loans can be slower to process; crowdfunding might generate quick capital if successful

Which Businesses Should Choose Crowdfunding?

Crowdfunding suits:

- Tech startups and creative industries

- Product-based businesses seeking validation

- Ventures with strong social or community impact

Which Businesses Should Opt for Small Business Loans?

Small business loans are better for:

- Businesses with a stable revenue stream

- Companies seeking expansion or equipment

- Firms with good credit histories needing predictable repayment

Real-world Examples and Success Stories

- Pebble Watch raised $10M on Kickstarter

- Flow Hive brought in $12.2M via reward crowdfunding

- Zano drone project raised £2.3M from 12,000 backers, but failed—highlighting crowdfunding risks

- Funding Guru helped SMEs denied loans secure alternative financing

How to Choose Between Crowdfunding and Loans: Decision-Making Tips

- Evaluate your business model: is it exciting and visual or steady and service-based?

- Review your credit score and existing financials

- Consider time sensitivity: crowdfunding campaigns can take months to plan

- Think about control: are you comfortable with outside shareholders?

Conclusion

There’s no one-size-fits-all approach. If your business has a marketable product and needs a buzz-generating launch, crowdfunding might be perfect. If you seek predictable repayments and control, secured small business loans could be your answer.

If you’re unsure which path to take, contact Funding Guru today for a no-obligation consultation.

At Funding Guru, we specialise in sourcing finance where others fail. Even if banks say no, we’ll look at alternative routes to help you grow.

FAQs about Crowdfunding and Small Business Loans

How does crowdfunding work?

You pitch your product or idea on a platform, and if enough backers pledge support, you receive the funds to proceed.

Crowdfunding vs loan: what’s better?

It depends—crowdfunding is ideal for innovation and visibility, while loans offer stability and less exposure.

Small business loans UK: what options exist?

Banks, government-backed Start Up Loans, and lenders like Funding Guru offer various packages based on your creditworthiness.

Are crowdfunding platforms reliable?

Yes, if you use well-established sites like Kickstarter or Crowdcube—but results vary widely.